Maintenance and Repair Challenges for Landlords Owning rental property in Hong Kong inevitably involves confronting......

Hong Kong's Robust Trust Framework for Wealth Defense Hong Kong is recognized as a leading......

Global Tax Reform Landscape Impacting Hong Kong The global tax landscape is undergoing a fundamental......

Determining Tax Residency Status For employees splitting their professional time between Hong Kong and Mainland......

Hong Kong's Tax Advantage Landscape Hong Kong is renowned for its business-friendly environment, anchored by......

Maximizing Tax Benefits: A Guide to Hong Kong's Deduction Framework Navigating Hong Kong's tax landscape......

BEPS Fundamentals and Global Tax Reform Goals The Base Erosion and Profit Shifting (BEPS) initiative,......

Navigating Cross-Border Wealth Complexity Managing wealth across the dynamic border between Hong Kong and Mainland......

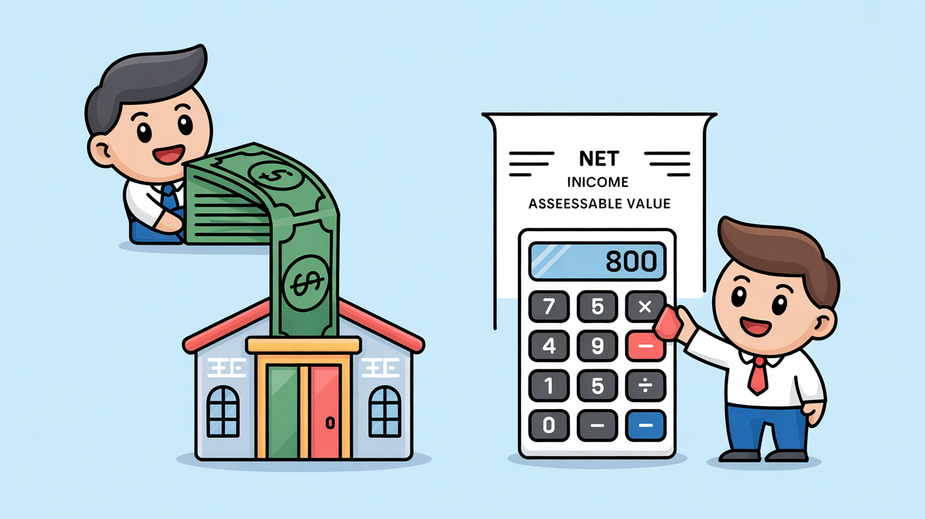

Understanding Net Assessable Value (NAV) Basics In Hong Kong, the Net Assessable Value (NAV) is......

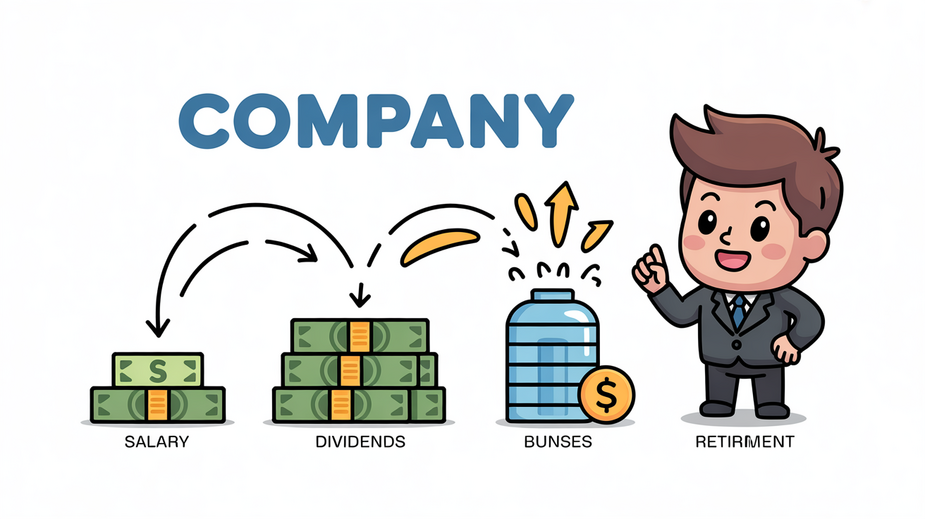

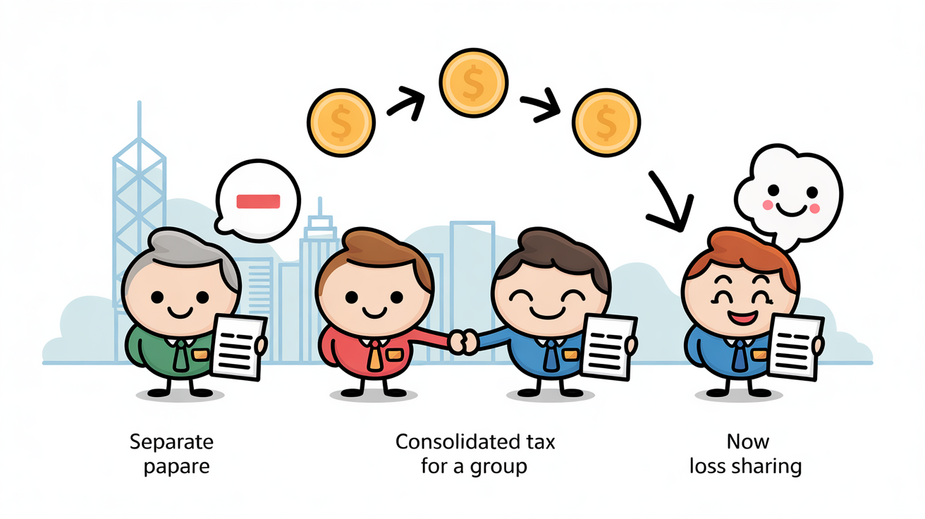

Hong Kong’s Corporate Tax Framework: Separate Entity Principle vs. Consolidated Options Hong Kong operates under......

Understanding Hong Kong's Two-Tier Profits Tax System A foundational element of effective tax planning for......

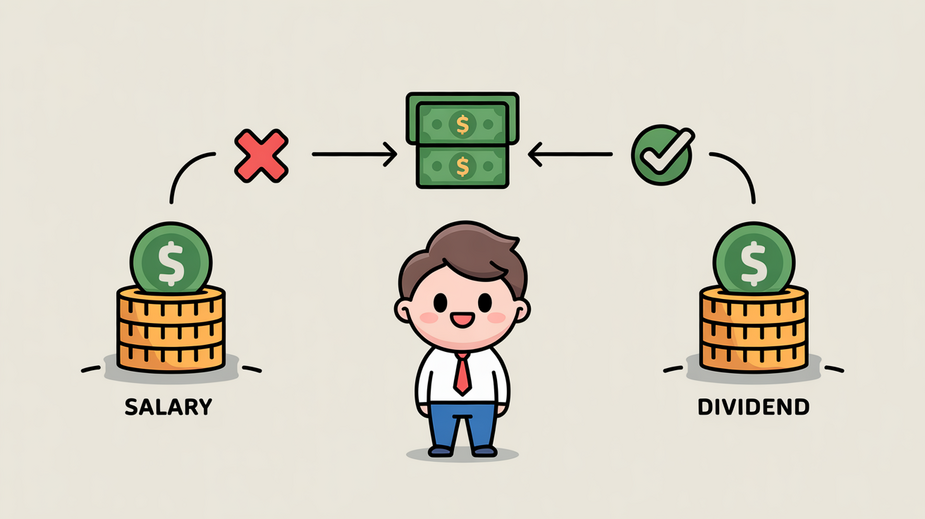

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308