Eliminating Double Taxation for Exporters A significant advantage for businesses trading between Hong Kong and......

The Global Challenge of Cross-Border Withholding Taxes Businesses operating across international borders frequently face the......

Navigating Hong Kong Offshore Tax Claims: Avoiding Common Pitfalls Businesses operating internationally often seek to......

Leveraging Hong Kong's Territorial Tax Principle Hong Kong's tax system operates on a fundamental territorial......

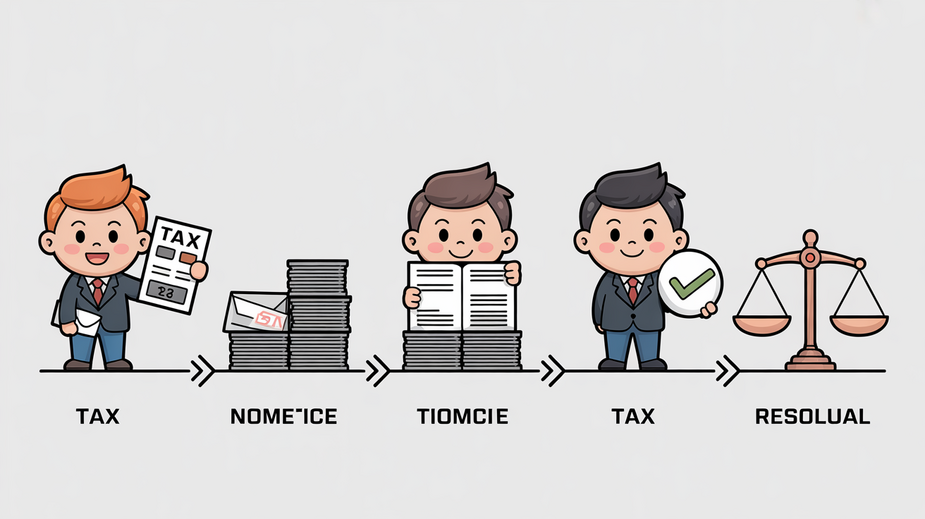

Receiving the Initial Investigation Notice The arrival of a tax investigation notice can understandably cause......

Defining Tax Residency in Hong Kong Understanding your tax residency status is a critical starting......

Understanding Double Taxation Risks in Global Business Navigating the international business landscape offers significant opportunities......

Navigating Hong Kong's Cross-Border Investment Tax Landscape Understanding the distinction between inbound and outbound investment......

Pandemic-Era Tax Policy Shifts in Hong Kong The onset of the COVID-19 pandemic posed significant......

Understanding Hong Kong’s Two-Tiered Tax Structure Hong Kong distinguishes itself with a competitive two-tiered profits......

Understanding Hong Kong’s Double Tax Treaty Network Double Tax Treaties (DTTs) are crucial international agreements......

Understanding the Proposed Luxury Goods Tax in Hong Kong Hong Kong's established position as a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308