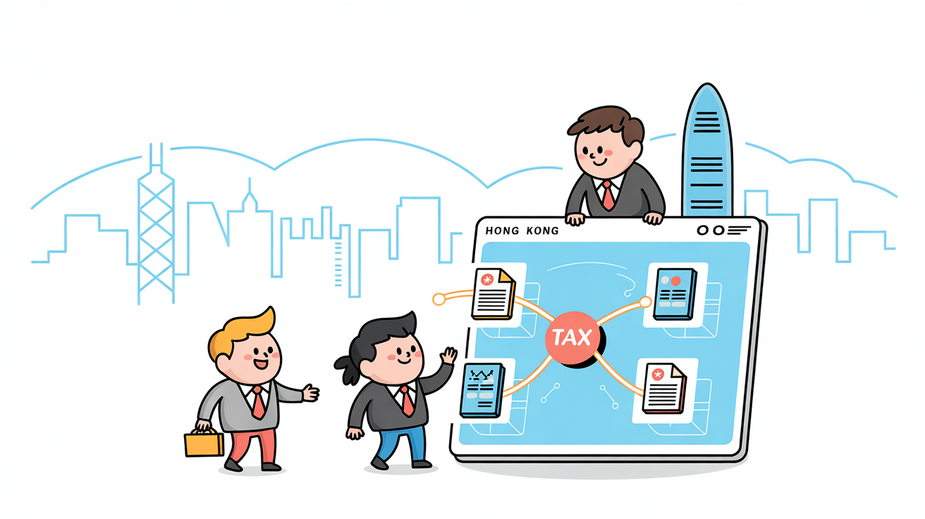

Hong Kong's Strategic Position for Wealth Management Hong Kong has long cemented its status as......

📋 Key Facts at a Glance Property Tax Rate: 15% on Net Assessable Value (rental......

📋 Key Facts at a Glance No Estate Duty: Hong Kong abolished estate duty for......

📋 Key Facts at a Glance Assessment Period: Standard back assessment period is 6 years,......

📋 Key Facts at a Glance Two-Tiered Profits Tax: 8.25% on first HK$2 million, 16.5%......

Defining the Role of a Hong Kong Tax Representative Navigating the complexities of Hong Kong's......

Transfer Pricing Fundamentals for Asian Hubs Transfer pricing, the mechanism by which multinational enterprises (MNEs)......

📋 Key Facts at a Glance Digital Transformation: IRD launching three new tax portals in......

📋 Key Facts at a Glance Hong Kong's Duty Landscape: Hong Kong maintains a free......

BEPS 2.0 and the Two-Pillar Framework Explained The international tax landscape is undergoing a significant......

📋 Key Facts at a Glance Investigation Scope: Standard tax investigations cover 6 years, but......

📋 Key Facts at a Glance Tax Rates for PEs: 8.25% on first HK$2 million......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308