Understanding Hong Kong Profits Tax Assessments Receiving a profits tax assessment from the Inland Revenue......

Key Facts: Hong Kong Tax Advantages for HNWIs No capital gains tax on investment profits......

📋 Key Facts at a Glance Primary Audit Focus: Offshore claims remain the IRD's top......

Private Foundations: A Pillar of Modern Wealth Preservation in Hong Kong In the evolving landscape......

📋 Key Facts at a Glance Stock Transfer Stamp Duty: 0.2% total (0.1% buyer +......

📋 Key Facts at a Glance Territorial System: Hong Kong has taxed only locally-sourced profits......

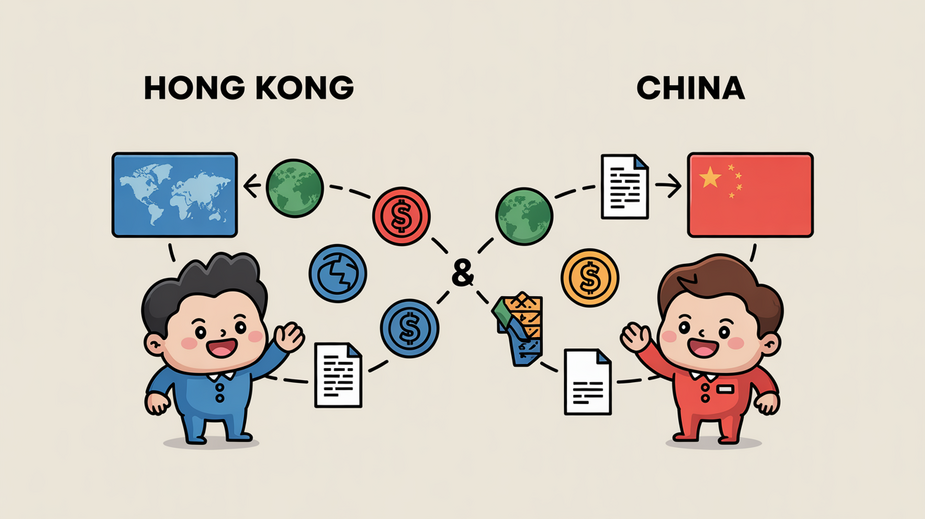

DTA Networks: Scope and Global Reach Double Tax Avoidance (DTA) treaties are essential tools for......

📋 Key Facts at a Glance Standard Rates: 5% of rateable value for all non-domestic......

Understanding Hong Kong's Two-Tier Tax Structure Hong Kong's profits tax system features a distinctive two-tiered......

📋 Key Facts at a Glance Extended Timelines: Hong Kong tax disputes can span 1-5+......

Understanding Eligible Self-Education Expenses for Tax Deduction in Hong Kong Navigating tax deductions for self-education......

Hong Kong's Tax Benefits for Single-Family Offices vs. Multi-Family Offices Key Facts: Hong Kong Family......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308