Hong Kong's SME Tax Framework: Key Features Hong Kong presents a highly appealing environment for......

📋 Key Facts at a Glance Hong Kong's DTA Network: Comprehensive Double Taxation Agreements with......

📋 Key Facts at a Glance Property Tax Rate: 15% flat rate on Net Assessable......

Understanding Forced Heirship and Hong Kong's Approach to Inheritance Navigating international inheritance laws presents unique......

Understanding Joint Tax Assessment Basics in Hong Kong In Hong Kong, Salaries Tax is generally......

Legal Rights and Obligations During a Hong Kong Tax Investigation Legal Rights and Obligations During......

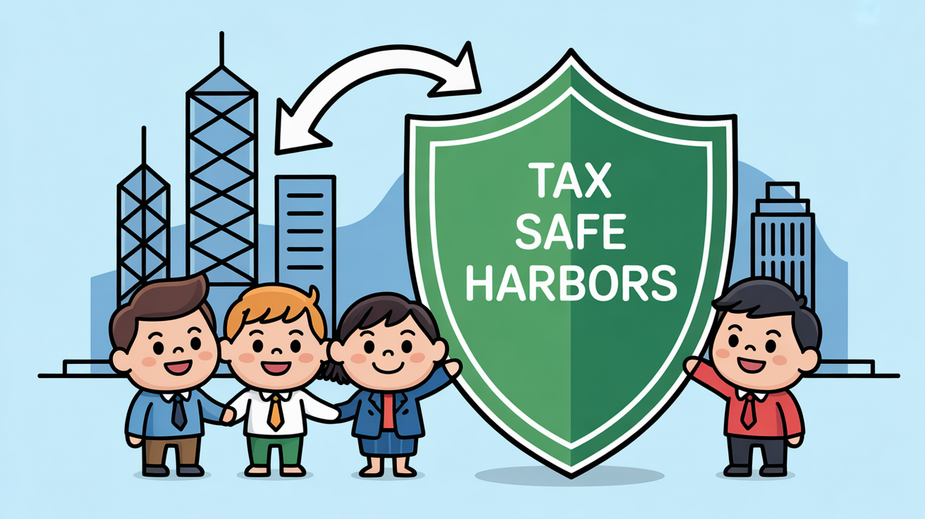

Decoding Hong Kong's Safe Harbor Framework for Transfer Pricing In the complex landscape of international......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308