ビジネス構造の重要性:香港における支店と子会社の税務上の影響

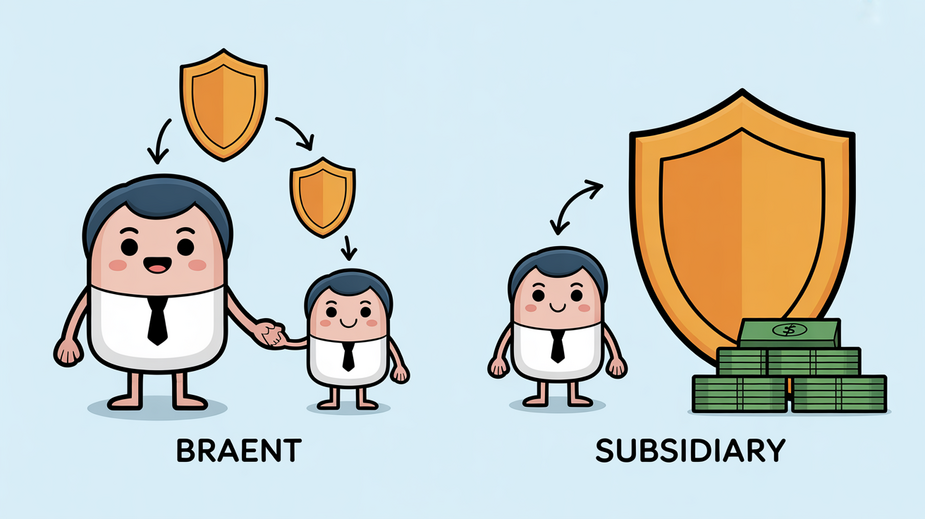

📋 ポイント早見 税率の違い: 香港法人は、最初の200万香港ドルの利益に8.25%、残額に16.5%の事業所得税(利得税)が適用されます(2024-25年度)。 法的地位: 支店は親会社の延長であり、子会社は独立した法人格を持ちます。 責任範囲: 子会社は有限責任を提供しますが、支店は親会社に無限責任を負わせます。 税制の原則: 香港は源泉地主義を採用しており、香港源泉の利益のみが課税対象です。 コンプライアンス: 子会社は完全な現地監査が必要ですが、支店の報告要件は比較的簡素です。 香港への進出を検討する際、「支店」と「子会社」のどちらを設立すべきか、お悩みではありませんか?この選択は、単なる手続きの違いではなく、無限責任のリスクを負うか資産を保護するか、利益に対して8.25%か16.5%の税率が適用されるかといった、事業の財務的健全性と将来の成長可能性を左右する根本的な戦略決定です。アジアへのゲートウェイとして戦略的な香港ですが、最適な組織形態は、具体的な事業目標、リスク許容度、長期的な計画によって大きく異なります。 戦略的決断:事業構造が重要な理由 香港に事業を展開する際、支店を設置するか子会社を設立するかの選択は、単なる法的形式を超えた戦略的決断です。シンプルな税制と源泉地主義によりビジネスフレンドリーな環境を提供する香港ですが、この選択は税負担、法的責任の範囲、運営の柔軟性に深い影響を与えます。最適な構造は、事業の規模、期間、リスク管理方針によって異なります。 ⚠️ 重要な注意: 香港は源泉地主義(Territorial Tax System)を採用しています。これは、香港で発生した利益のみが事業所得税の課税対象となることを意味します。この原則は支店・子会社の両方に適用されますが、実務上の影響は構造によって大きく異なります。 支店:延長モデル 香港の支店は独立した法人格を持たず、外国の親会社の延長部分とみなされます。法的には親会社の一部であり、この根本的な特性が支店運営のあらゆる側面を形作ります。 支店の主な特徴 独立した法人格なし: 支店は親会社の名前と法的資格の下で運営されます。 無限責任: