Misunderstanding Hong Kong's Territorial Tax Principle One of the most significant and potentially costly errors......

Why Hong Kong Attracts Global Family Offices Hong Kong stands as a premier international financial......

The Future of Hong Kong's Tax Regime for Family Offices: Trends and Predictions The Future......

Hong Kong's Tax Treatment of Cryptocurrency Investments: A Practical Breakdown Key Facts: Hong Kong Cryptocurrency......

Key Facts at a Glance Property Rates 5% of rateable value Recurring annual tax (paid......

Understanding Family Offices in Hong Kong Family offices are sophisticated private wealth management structures designed......

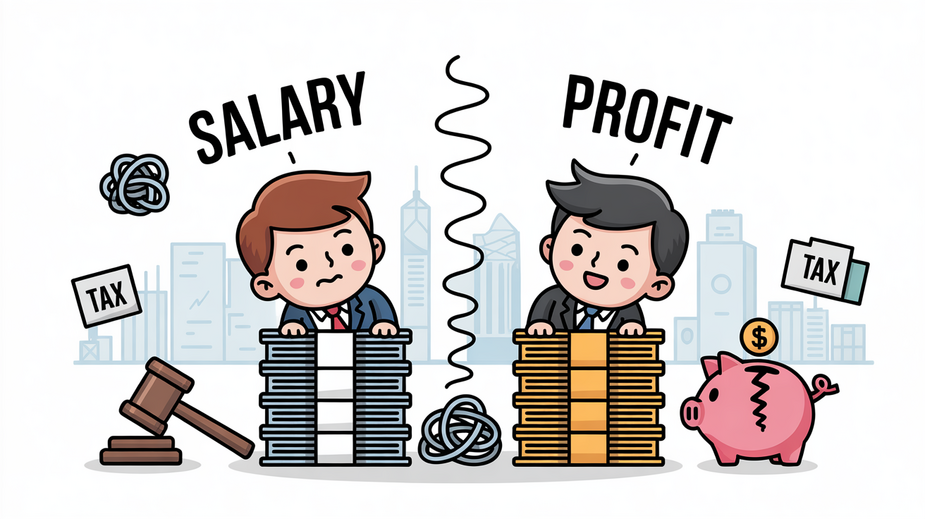

The Crucial Distinction: Director Remuneration vs. Profit Distribution in Hong Kong In Hong Kong corporate......

Defining Intellectual Property Income Under Hong Kong Tax Law Understanding the tax implications for income......

Understanding Hong Kong's Corporate Tax Framework Navigating the complexities of corporate taxation in Hong Kong......

Understanding Hong Kong’s Tax-Efficient Dividend Framework Hong Kong presents a highly attractive tax environment, particularly......

Core Mechanics of Hong Kong Limited Partnerships Understanding the foundational structure of a Hong Kong......

Why Double Taxation Threatens Global Business Growth Operating a business across international borders offers significant......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308