The Strategic Power of Hong Kong's DTA Network Hong Kong's extensive network of Double Taxation......

Hong Kong’s Distinct Tax Framework for Regional Operations Hong Kong stands as a leading international......

Decoding BEPS Action Plan 13 Requirements Transfer pricing documentation is fundamental to enabling tax administrations......

Key Facts: Hong Kong Tax Audit Response Two Audit Types: The IRD conducts desk audits......

Hong Kong's Territorial Tax System Explained Hong Kong operates a distinct territorial basis of taxation,......

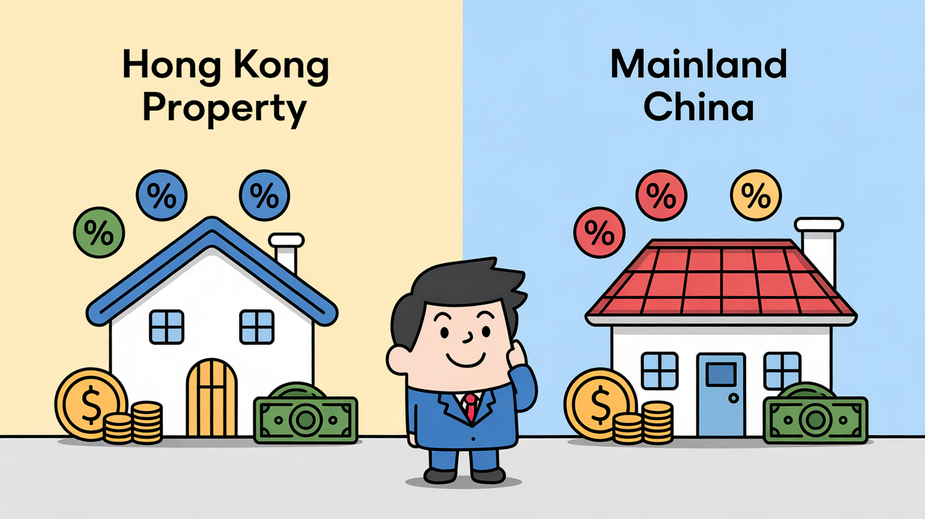

Key Facts: Hong Kong Property Stamp Duty Major Policy Change: All demand-side management measures (BSD,......

Cross-Border Property Investment Tax Landscape The evolving economic relationship between Hong Kong and Mainland China......

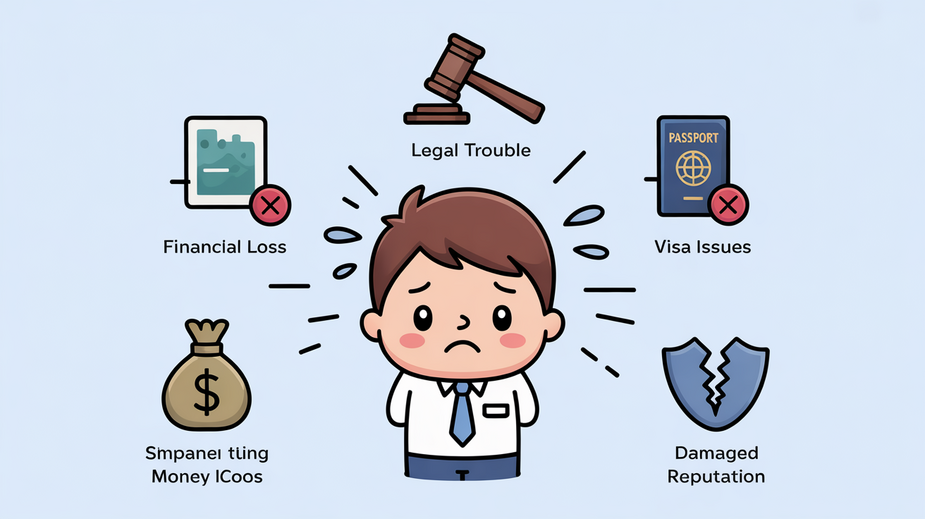

Financial Consequences Beyond Direct Fines Navigating tax obligations in a new country presents inherent complexities.......

Understanding MPF Tax Deduction Fundamentals The Mandatory Provident Fund (MPF) is Hong Kong's compulsory retirement......

Tax Residency Definitions and Scope Navigating the tax landscape as a non-resident entrepreneur operating within......

```html Understanding Hong Kong's Deduction Framework Navigating personal tax deductions in Hong Kong requires a......

Mainland China-Hong Kong Tax Treaties: Structuring Your Business for Compliance Mainland China-Hong Kong Tax Treaties:......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308