Understanding Hong Kong's Property Rate System Navigating property ownership or tenancy in Hong Kong necessitates......

Understanding Hong Kong Lease Stamp Duty Fundamentals Navigating the legal landscape of rental agreements in......

Understanding Hong Kong's Double Taxation Treaty Network A cornerstone of effective international tax planning and......

Hong Kong's Renewable Energy Tax Incentives Overview Hong Kong has strategically advanced its commitment to......

Core Tax Structures Compared Understanding the fundamental tax structures applied to property income in Hong......

Key Updates to Hong Kong’s ESG Tax Framework Hong Kong's commitment to fostering a sustainable......

Understanding Double Taxation Agreements (DTAs) Double Taxation Agreements (DTAs) are foundational international treaties designed to......

Understanding Hong Kong's Property Rates System Operating a business in Hong Kong necessitates a clear......

Why Proper eTAX Archiving Is Non-Negotiable Maintaining accurate and accessible tax records is a fundamental......

Hong Kong's Tax Landscape for Expat Benefits Navigating the tax implications of compensation packages presents......

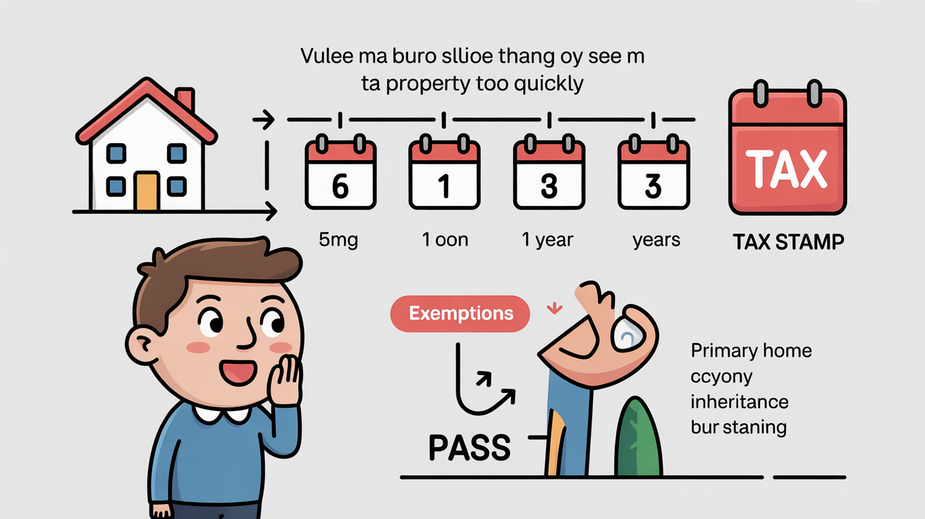

Understanding Hong Kong's Special Stamp Duty (SSD) Framework Hong Kong's property market is renowned for......

Core Legal Obligations for Multiple Income Streams Navigating Salaries Tax in Hong Kong presents specific......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308