Key Facts: Hong Kong Property Rates Appeals Legal Framework: Rating Ordinance (Cap. 116) governs all......

Understanding Salaries Tax for Married Couples in Hong Kong Getting married in Hong Kong signifies......

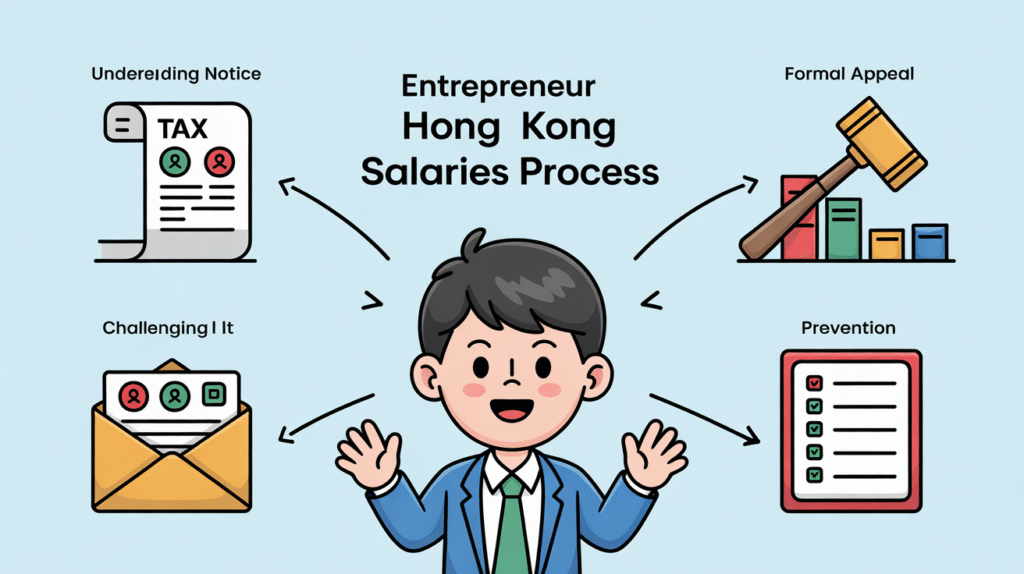

Understanding Your Salaries Tax Assessment Notice Receiving your Hong Kong Salaries Tax assessment notice from......

Understanding Offshore Trusts in Hong Kong An offshore trust is a sophisticated legal arrangement where......

Core Income Documentation for Employees Accurately preparing your Hong Kong tax return as an employee......

Navigating Hong Kong's Investment Tax Landscape Investing in Hong Kong presents a unique tax environment,......

Key Facts Effective Date Phase 1: January 1, 2023 - Covers foreign-sourced dividends, interest, IP......

Navigating Cross-Border Profit Repatriation from China to Hong Kong Repatriating profits from a Chinese subsidiary......

Hong Kong's Tax Compliance for Cryptocurrency Businesses: Emerging Regulations Hong Kong's Tax Compliance for Cryptocurrency......

Key Facts: Hong Kong Property Rates for Small Businesses 📊 Rate Percentage 5% of rateable......

The Entrepreneur's Cross-Border Retirement Challenge Relocating to a new country presents numerous logistical and financial......

Navigating Cross-Border Estate Planning from Hong Kong Hong Kong's standing as a vibrant international financial......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308