📋 Key Facts at a Glance Standard Deadline: 2 years from instrument date or cancellation......

Tax Residency Definitions and Scope Navigating the tax landscape as a non-resident entrepreneur operating within......

Current State of Hong Kong's Tax Treaty Landscape Hong Kong's extensive network of Double Taxation......

📋 Key Facts at a Glance Fact 1: MPF voluntary contributions offer tax deductions up......

The Nuances of Hong Kong's Territorial Taxation Principle Hong Kong is often celebrated for its......

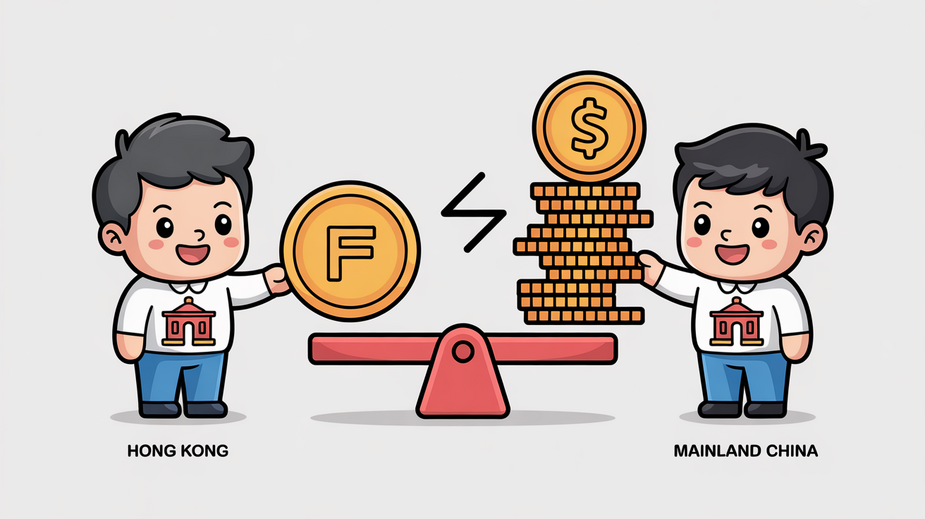

Escalating Financial Risks in Mainland China The economic and regulatory landscape within Mainland China has......

Hong Kong's Inheritance Landscape: Key Advantages and Global Context For entrepreneurs based in Hong Kong,......

Hong Kong’s Foundational Legal Framework for Asset Protection Hong Kong's legal system, deeply rooted in......

📋 Key Facts at a Glance No Estate Duty: Hong Kong abolished estate duty for......

📋 Key Facts at a Glance Property Tax Rate: 15% on Net Assessable Value (rental......

Hong Kong's Evolving Tax Landscape: An Overview for Non-Residents Hong Kong maintains a tax system......

📋 Key Facts at a Glance Hong Kong Property Tax: 15% on net assessable value......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308