📋 Key Facts at a Glance Authentication Methods: iAM Smart/iAM Smart+ digital authentication, TIN +......

Tax Residency Definitions and Implications Understanding where you are considered a tax resident is the......

📋 Key Facts at a Glance Zero Tax on Fund Profits: Hong Kong's Unified Fund......

📋 Key Facts at a Glance Comprehensive Treaty Network: Hong Kong has signed comprehensive Double......

Why Double Taxation Threatens Global Business Growth Operating a business across international borders offers significant......

Understanding Personal Allowances in Hong Kong Navigating personal income tax requires a clear understanding of......

Understanding Hong Kong Salaries Tax Fundamentals Navigating tax obligations in any jurisdiction requires a clear......

Hong Kong's Territorial Tax System Explained Hong Kong operates a territorial tax system, a fundamental......

Core Income Documentation for Employees Accurately preparing your Hong Kong tax return as an employee......

Strategic Importance of Jurisdiction Selection for Holding Structures Choosing the optimal jurisdiction for establishing a......

Understanding Profits Tax for Hong Kong Joint Ventures Navigating the complexities of profits tax is......

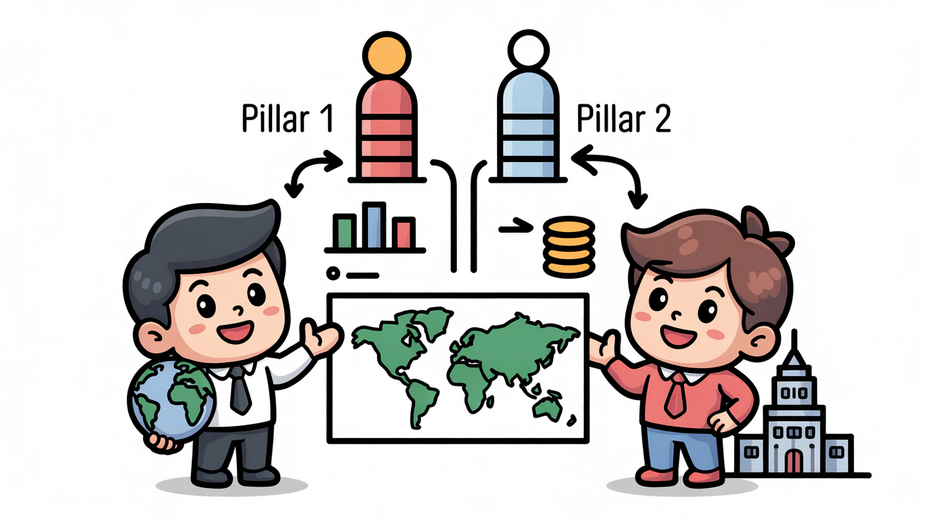

BEPS 2.0 and the Two-Pillar Framework Explained The international tax landscape is undergoing a significant......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308