Understanding Double Taxation Relief Fundamentals Operating across international borders, whether as an individual earning income......

The Evolution of Tax Compliance in Hong Kong Tax compliance in Hong Kong is undergoing......

Fundamental Tax System Differences Understanding the core tax principles governing Hong Kong and Mainland China......

Understanding Dual Tax Regimes: Hong Kong vs Mainland China Operating a business with entities in......

Hong Kong’s Stamp Duty Relief Explained Hong Kong levies stamp duty on specific transactions, primarily......

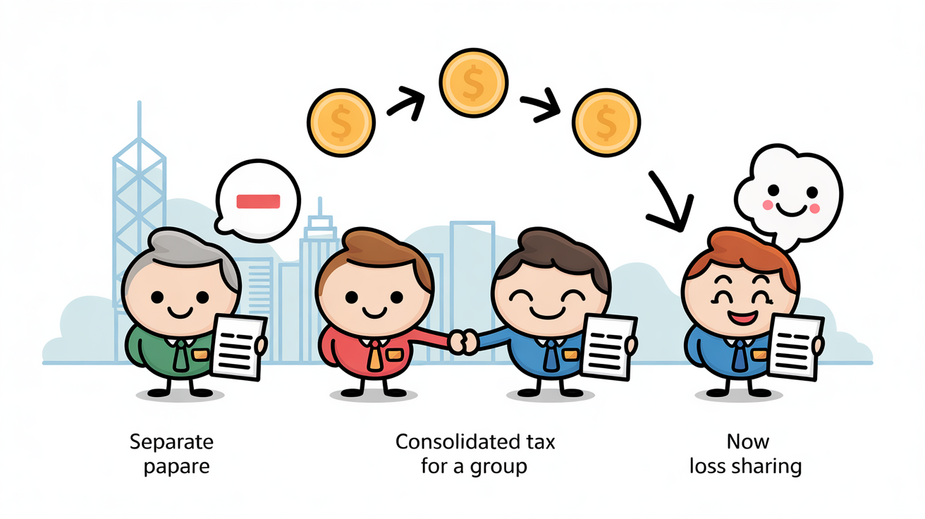

Hong Kong’s Corporate Tax Framework: Separate Entity Principle vs. Consolidated Options Hong Kong operates under......

Understanding Home Loan Interest Deductions in Hong Kong In Hong Kong, the tax-deductible mortgage interest......

Understanding Trust Distributions and Tax Liability in Hong Kong For individuals receiving distributions from a......

Understanding Withholding Tax Fundamentals Withholding tax serves as a foundational element of international taxation, primarily......

Understanding Capital Allowances in Hong Kong Navigating business finances effectively requires a clear understanding of......

Understanding Hong Kong Stamp Duty Stamp duty in Hong Kong is a transactional tax applied......

Why Tax Compliance Matters from Day One for Hong Kong Startups Launching a startup in......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308