Understanding Hong Kong’s Salaries Tax and Personal Allowances Navigating any tax system begins with understanding......

Understanding Hong Kong's Education Tax Relief Framework Hong Kong's tax system provides specific provisions offering......

Understanding Hong Kong's Territorial Tax System Hong Kong operates under a distinctive and generally favorable......

Understanding Hong Kong's Transfer Pricing Framework in a Global Context Hong Kong has established a......

Why Currency Volatility Impacts Rental Tax Liability For foreign landlords receiving rental income in a......

Understanding Tax Audits in Hong Kong Navigating the tax landscape in Hong Kong necessitates an......

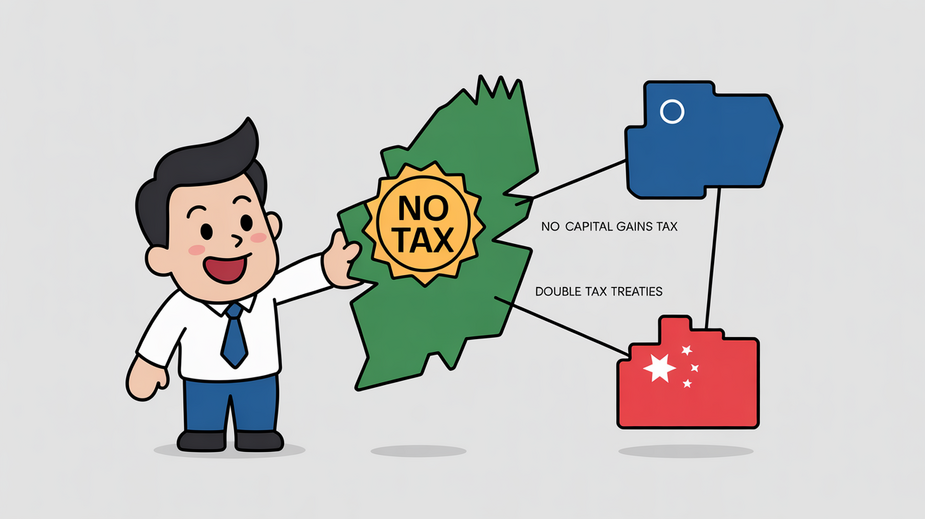

Hong Kong's Strategic Tax Treaty Network Hong Kong has strategically cultivated an extensive network of......

Hong Kong's Approach to Taxing Capital Gains Hong Kong operates under a territorial basis of......

Greater Bay Area's Strategic Role in China's Economy The Greater Bay Area (GBA) initiative stands......

Understanding Taxable Rental Income Sources in Hong Kong For small and medium-sized enterprises (SMEs) in......

```html Understanding Hong Kong's Deduction Framework Navigating personal tax deductions in Hong Kong requires a......

Understanding Cross-Border Donation Tax Frameworks Donating from Hong Kong to Mainland China involves navigating two......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308