Hong Kong's Evolving Trust Landscape for Global Businesses Hong Kong maintains its prominent position as......

Profits Tax Fundamentals for Hong Kong Businesses Operating a business in Hong Kong requires a......

Understanding Hong Kong's Stamp Duty Framework Hong Kong's stamp duty system is a foundational element......

Hong Kong’s Territorial Tax System and Offshore Exemption A fundamental element underpinning Hong Kong's attractiveness......

Key Facts: Hong Kong Property Rates System Historical Origins: First Rating Ordinance enacted in 1845......

The Hidden Costs of Manual Tax Filing vs. Hong Kong's eTAX System Key Facts: eTAX......

Hong Kong vs. Singapore: Positioning as Global Wealth Hubs Hong Kong and Singapore have long......

Strategic Significance of the HK-Netherlands DTA The Double Taxation Agreement (DTA) between Hong Kong and......

BEPS 101: Reshaping Global Tax Governance The Base Erosion and Profit Shifting (BEPS) initiative, spearheaded......

Understanding Offshore Claims and Their Benefits Navigating Hong Kong's distinctive territorial tax system is crucial......

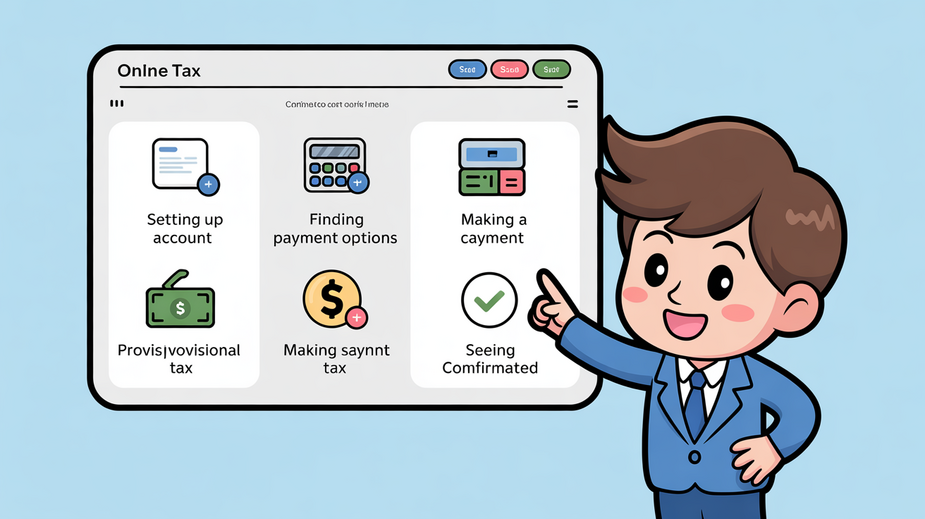

How to Use Hong Kong's eTAX Portal for Provisional Tax Payments Key Facts: Hong Kong......

Understanding Hong Kong's Capital Gains Tax Framework Individuals managing investments or operating within Hong Kong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308