Eligibility Criteria for Marriage-Based Tax Benefits in Hong Kong Accessing the tax benefits available to......

Identifying Potential Issues in Hong Kong Tax Assessments Reviewing a tax assessment carefully is a......

How Tax Deductions for Charitable Donations Work in Hong Kong Making charitable contributions can be......

The Influence of Stamp Duty on Property Valuation and Transactions In Hong Kong, stamp duty......

Hong Kong's Strategic Tax Position for Wealth Management Hong Kong maintains a prominent position as......

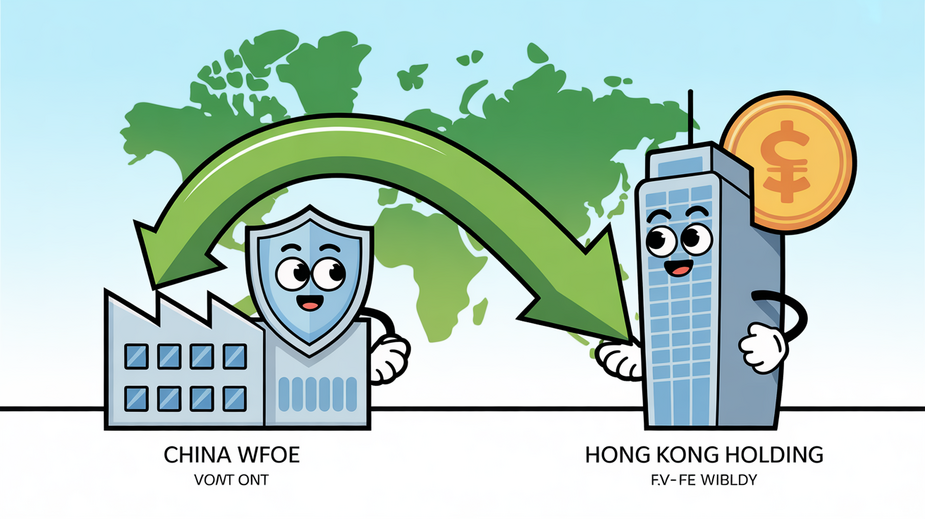

Tax Efficiency Advantages for Cross-Border Profits A fundamental benefit of establishing a Hong Kong holding......

Core Tax Systems: Territorial vs. Worldwide Understanding the fundamental tax systems of Hong Kong and......

Anti-Dumping Duties: Core Concepts and Scope Anti-dumping measures constitute a vital component of international trade......

Understanding Hong Kong's Favorable Tax Landscape Hong Kong is widely recognised for operating one of......

Understanding Family Offices in the Hong Kong Context In Hong Kong's dynamic financial landscape, comprehending......

Critical Documentation Red Flags in Audits In the landscape of tax compliance, thorough and accurate......

Optimizing Wealth Management: Hong Kong's Family Office Tax Exemption Hong Kong has significantly enhanced its......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308