Understanding Hong Kong's Tax Treaty Network for Retirement Planning For individuals strategically planning their retirement......

Understanding Non-Resident Director Status and Hong Kong Tax Navigating tax reporting obligations in Hong Kong......

Key Facts The Hong Kong IRD has legal authority under Section 51 of the Inland......

Defining Deductible Professional Fees in Hong Kong Understanding what constitutes a deductible professional fee is......

Why Traditional Retirement Plans Fall Short for Digital Nomads The conventional approach to retirement planning......

Hong Kong's Competitive and Territorial Tax System Hong Kong stands as a preeminent international financial......

Understanding Hong Kong's Two-Tiered Salaries Tax System Hong Kong employs a distinctive two-tiered system for......

Hong Kong Trusts as Cross-Border Wealth Management Tools Hong Kong trusts, built upon robust English......

Understanding Advanced Pricing Agreements (APAs) and Hong Kong's Framework Advanced Pricing Agreements (APAs) represent a......

Understanding Core Tax Structures When evaluating corporate tax environments, the foundational tax structures of Hong......

Understanding Taxable Rental Income Sources in Hong Kong For small and medium-sized enterprises (SMEs) in......

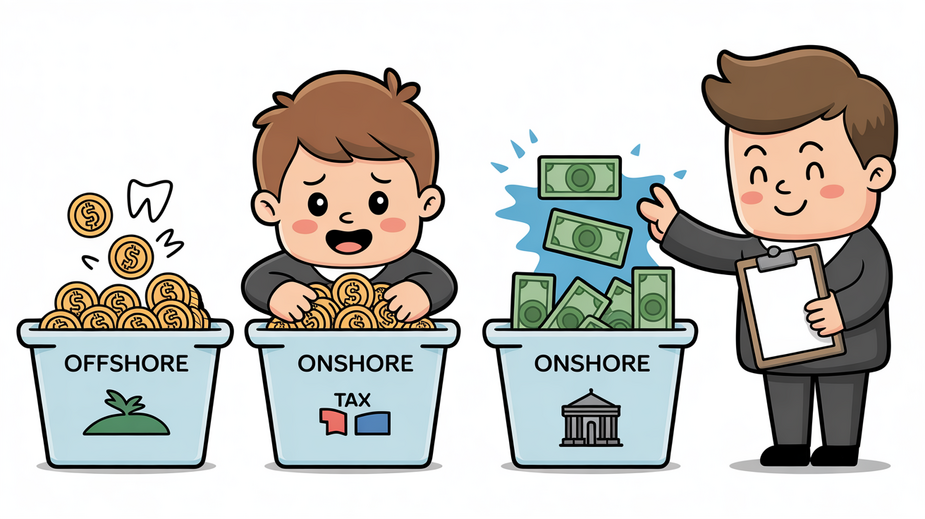

Offshore Income Classification Basics Understanding the fundamental distinction between offshore and onshore income is crucial......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308