The Rising Imperative of Global Tax Transparency In today's increasingly interconnected global economy, the movement......

Understanding Hong Kong's Territorial Tax System One of the most significant advantages of the Hong......

Understanding Double Taxation Agreements (DTAs) Double Taxation Agreements (DTAs) are foundational international treaties designed to......

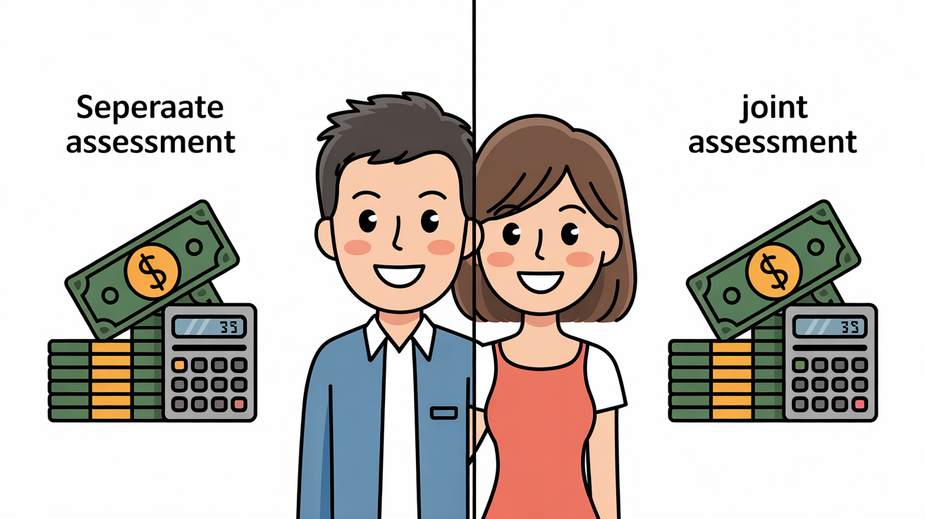

Understanding Salaries Tax for Married Couples in Hong Kong Getting married in Hong Kong signifies......

Understanding Hong Kong Tax Investigation Triggers Tax investigations in Hong Kong, while sometimes perceived as......

Foundations of Legal Systems Compared Understanding the fundamental legal systems governing Hong Kong and mainland......

Understanding Allowable Expense Fundamentals Navigating the complexities of property tax in Hong Kong requires a......

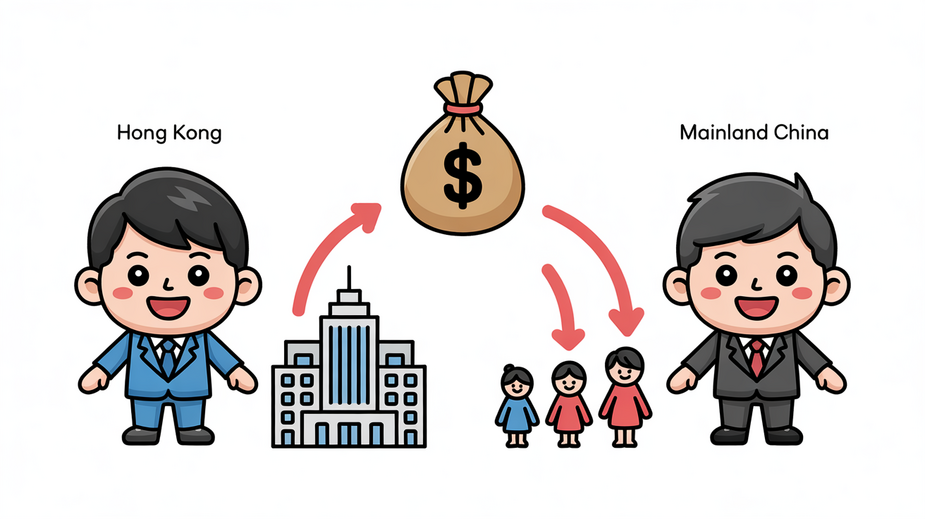

Navigating Permanent Establishment Thresholds in Hong Kong and Mainland China Understanding when a company establishes......

Understanding Hong Kong's Transfer Pricing Framework For foreign businesses operating in Hong Kong, a clear......

Understanding Tax Implications of Marriage in Hong Kong Entering into marriage significantly alters various aspects......

Understanding Co-Ownership Structures in Hong Kong In Hong Kong, navigating property ownership with multiple parties......

Remote Work Revolution Meets Tax Complexity The global professional landscape has been profoundly reshaped by......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308