East-West Communication Styles in Tax Negotiations Navigating a tax dispute in a cross-cultural environment like......

Understanding Hong Kong's eTAX Ecosystem Navigating tax obligations in Hong Kong relies heavily on the......

Hong Kong Salaries Tax Fundamentals Understanding the foundational principles of Hong Kong's Salaries Tax system......

BEPS 2.0 and the Two-Pillar Framework Explained The international tax landscape is undergoing a significant......

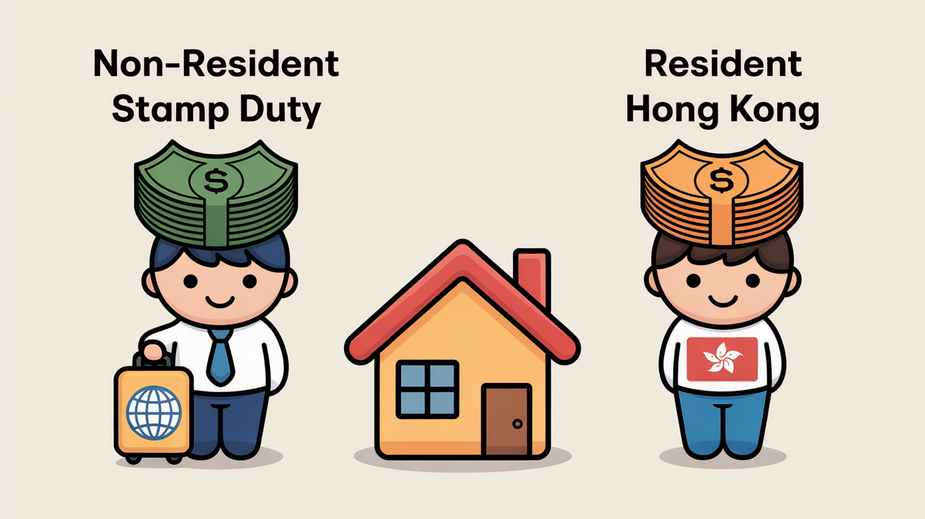

Hong Kong Stamp Duty Framework Explained Understanding Hong Kong's stamp duty framework is essential for......

Navigating Hong Kong's Stamp Duty Framework for Securities Hong Kong maintains a well-established stamp duty......

Error: No article content was provided for editing. Please provide the full text of the......

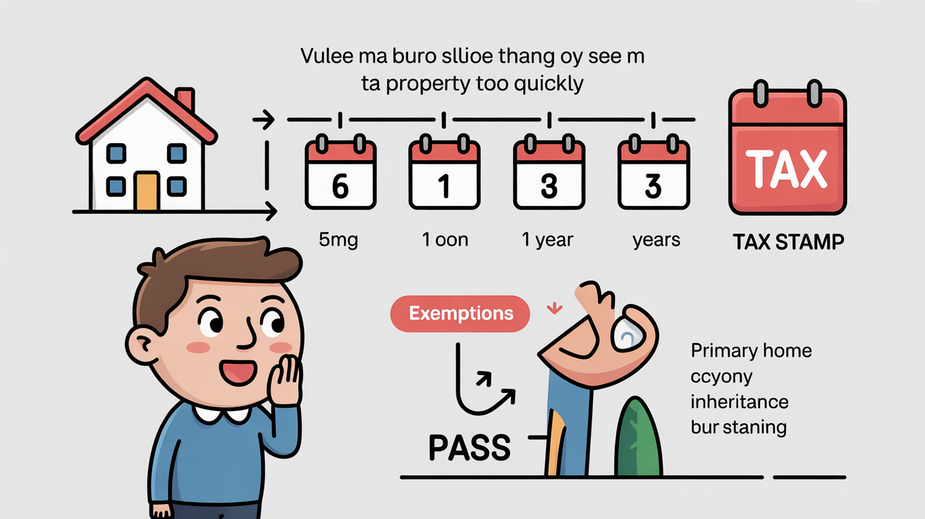

Understanding Hong Kong's Special Stamp Duty (SSD) Framework Hong Kong's property market is renowned for......

Understanding Hong Kong’s Salaries Tax and Personal Allowances Navigating any tax system begins with understanding......

Understanding Hong Kong REIT Stamp Duty Stamp duty in Hong Kong is a significant tax......

Understanding Advanced Pricing Agreements (APAs) and Hong Kong's Framework Advanced Pricing Agreements (APAs) represent a......

Hong Kong's Territorial Source Principle and Profits Tax Hong Kong operates under a territorial source......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308