Why Double Taxation Threatens Global Business Growth Operating a business across international borders offers significant......

Understanding VAT and GST-Free Fundamentals Navigating the complexities of international trade requires a clear understanding......

Understanding Double Taxation Relief Fundamentals Operating across international borders, whether as an individual earning income......

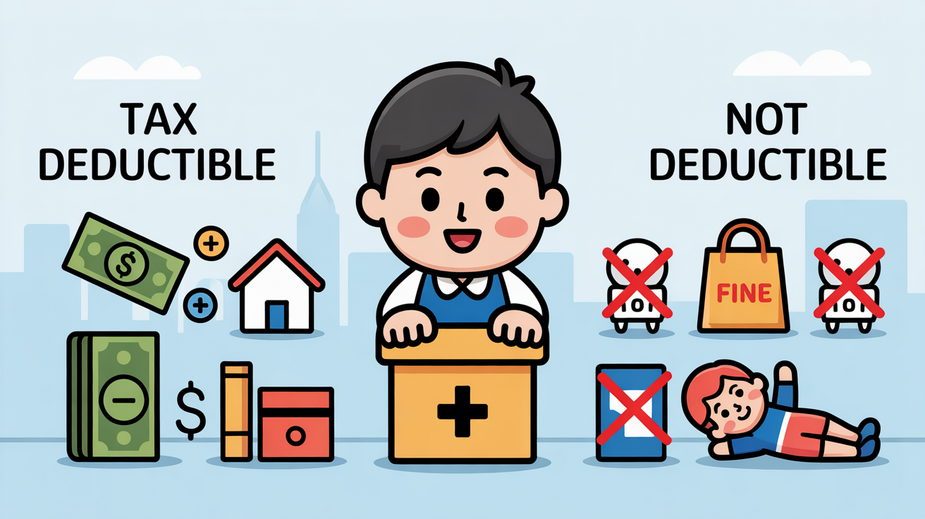

Maximizing Tax Savings: A Guide to Hong Kong Tax Deductions and Allowances Understanding the intricacies......

Hong Kong's Profits Tax Framework and Exemption Principles Navigating Hong Kong's profits tax system effectively......

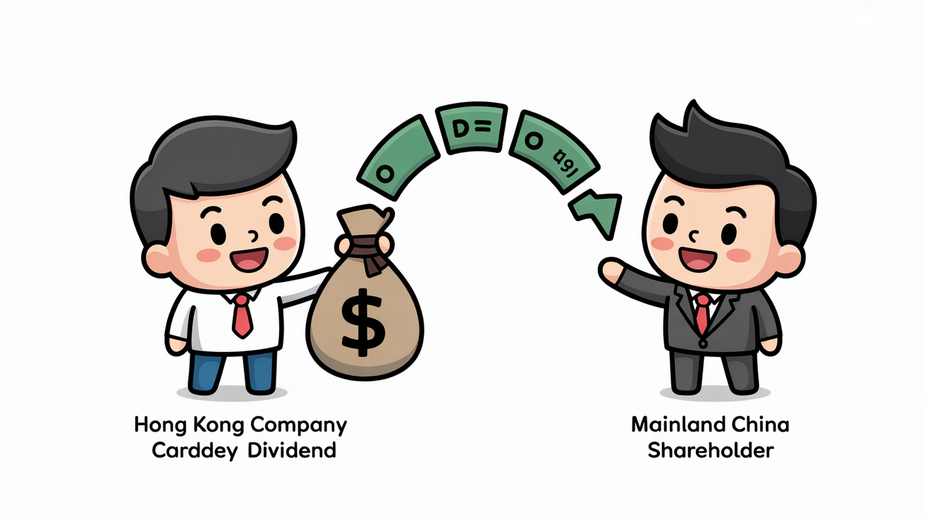

Understanding Cross-Border Dividend Tax Between Hong Kong and Mainland China Navigating the tax implications when......

Understanding Salaries Tax Obligations in Hong Kong Navigating your tax responsibilities in Hong Kong begins......

Understanding Hong Kong's Territorial Tax System Hong Kong operates a distinct territorial basis of taxation......

Understanding Hong Kong Property Tax for Rental Income Navigating the intricacies of Hong Kong's property......

Residency Status and Tax Liability Thresholds For expatriates working remotely from Hong Kong, a clear......

Understanding Hong Kong's Property Tax Framework Property tax forms a cornerstone of Hong Kong's tax......

Hong Kong's Current Profits Tax Landscape Hong Kong is globally recognized for its straightforward and......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308