Core Principles of Hong Kong's Anti-Avoidance Tax Regulations Hong Kong's tax system, renowned for its......

Core Types of Property Co-Ownership in Hong Kong Understanding the fundamental structures available for joint......

Initial Tax Obligations: Rent vs. Sale of Hong Kong Property Choosing whether to rent out......

Understanding Statutory Deadlines for Tax Appeals in Hong Kong Successfully navigating the tax appeal process......

Understanding Customs Audit Risks in Hong Kong Businesses operating internationally, particularly through dynamic trade hubs......

Recent Tax Reforms Reshaping Audit Priorities Recent tax reforms in Hong Kong are fundamentally altering......

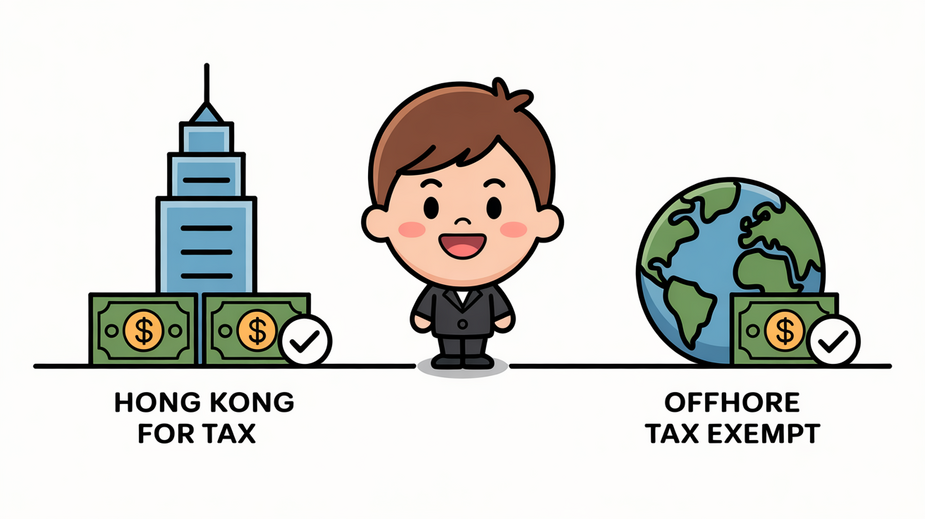

Hong Kong's Territorial Tax System Explained Hong Kong operates a territorial basis of taxation, a......

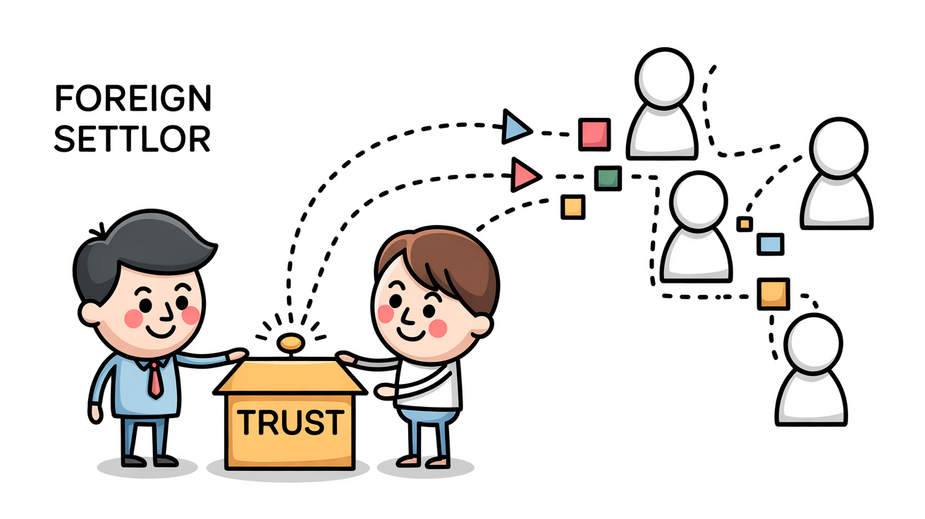

Hong Kong's Strategic Advantage in Cross-Border Wealth Management Hong Kong stands as a preeminent international......

Navigating the Evolving Landscape of Global Tax Regulations The international tax environment is undergoing continuous......

Navigating Inland Revenue Department Audits in Hong Kong Preparing for a potential Inland Revenue Department......

Understanding the OECD’s CRS Framework The Common Reporting Standard (CRS), an initiative spearheaded by the......

Optimizing Hong Kong's eTAX Experience for Expedited Tax Refunds Hong Kong's eTAX system serves as......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308