Understanding Home Loan Interest Deductions in Hong Kong In Hong Kong, the tax-deductible mortgage interest......

Understanding Hong Kong's Stamp Duty Basics Stamp duty constitutes a significant transaction cost within the......

E-Commerce Growth and Hong Kong's Digital Landscape Hong Kong's economy is undergoing a significant transformation,......

Hong Kong's Robust Trust Framework for Wealth Defense Hong Kong is recognized as a leading......

Understanding Hong Kong's Source-Based Taxation and Non-Domicile Status Hong Kong operates a territorial tax system,......

Understanding Hong Kong's Stamp Duty Framework Stamp duty is a fundamental component of Hong Kong's......

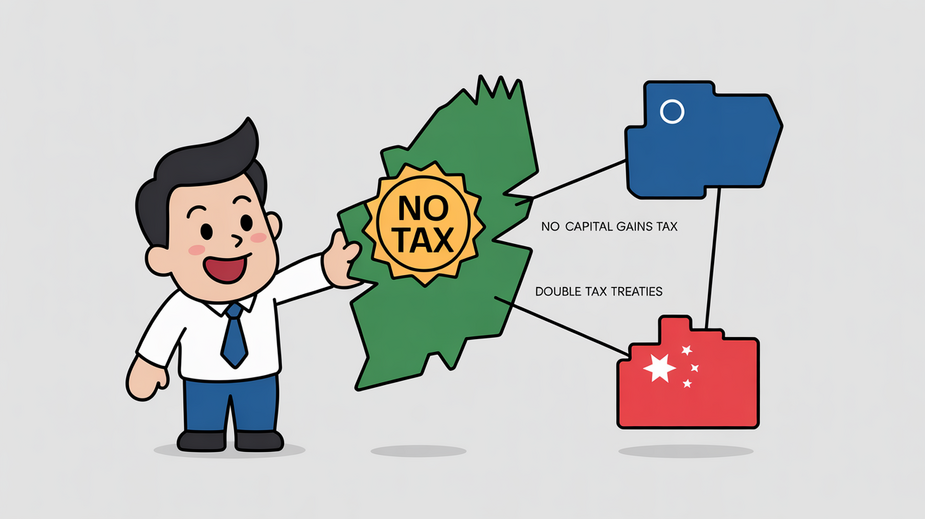

Understanding Hong Kong's Double Tax Treaty Network Hong Kong boasts a wide and expanding network......

Eligible Charitable Organizations in Hong Kong Understanding which charitable organizations qualify for tax deductions is......

Navigating Wealth Transfer in Hong Kong: A Comprehensive Guide Effective financial planning involves more than......

Hong Kong's Tax System as a Strategic Advantage For foreign-owned small and medium-sized enterprises (SMEs),......

Navigating E-commerce Tax Obligations in Hong Kong Understanding the tax landscape for an e-commerce business......

Hong Kong's Approach to Taxing Capital Gains Hong Kong operates under a territorial basis of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308