📋 Key Facts at a Glance Fifth Protocol Effective: Signed July 19, 2019; effective from......

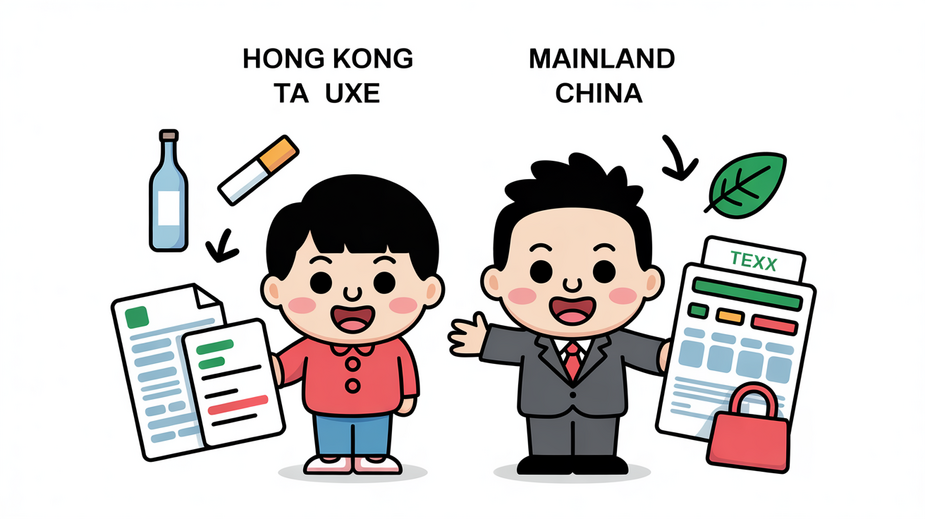

Understanding Dual Tax Regimes: Hong Kong vs Mainland China Operating a business with entities in......

Deadline-Driven Deductions to Prioritize As the calendar year approaches its end, taxpayers in Hong Kong......

📋 Key Facts at a Glance Free Port Advantage: Hong Kong imposes no customs tariffs,......

📋 Key Facts at a Glance Critical Deadline: You have exactly one month from the......

📋 Key Facts at a Glance Hong Kong's Free Port Status: Maintains minimal excise duties......

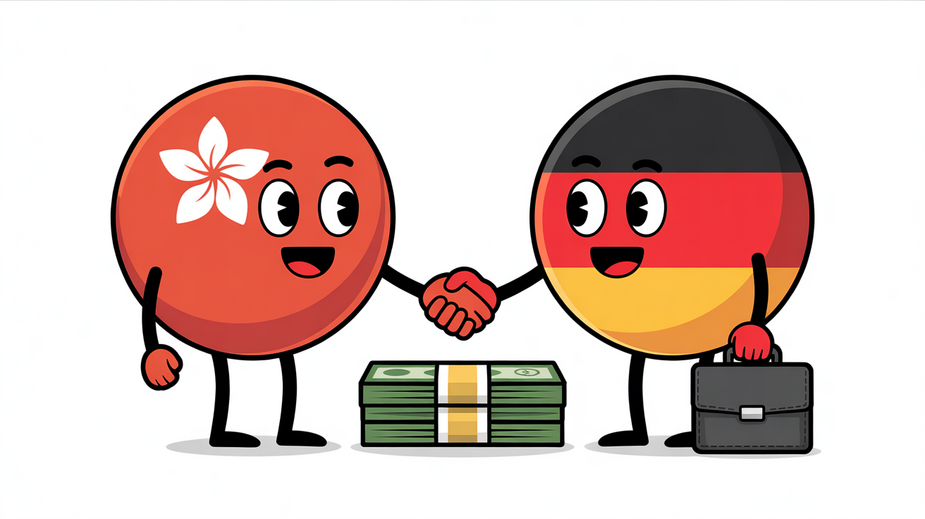

Strategic Value of the Hong Kong-Germany Double Taxation Agreement The economic relationship between Hong Kong......

Transfer Pricing Fundamentals in the Digital Ecosystem Transfer pricing is the essential mechanism by which......

Understanding Hong Kong's Property Tax Framework Hong Kong's property tax system is a fundamental element......

Understanding Provisional Tax in Hong Kong Hong Kong's tax system incorporates Provisional Tax, a mechanism......

Initial Tax Obligations: Rent vs. Sale of Hong Kong Property Choosing whether to rent out......

Hong Kong Property Tax Overview Hong Kong maintains a reputation for a simple and low-rate......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308