Hong Kong's Strategic Tax Treaty Network Hong Kong has strategically cultivated an extensive network of......

📋 Key Facts at a Glance Comprehensive Treaty Network: Hong Kong has signed comprehensive Double......

📋 Key Facts at a Glance Simplified Stamp Duty Regime: Since February 28, 2024, only......

How Tax Deductions for Charitable Donations Work in Hong Kong Making charitable contributions can be......

📋 Key Facts at a Glance No Separate Gig Worker Category: Hong Kong law doesn't......

Hong Kong's Strategic Advantages for Wealth Preservation Hong Kong stands as a prominent international financial......

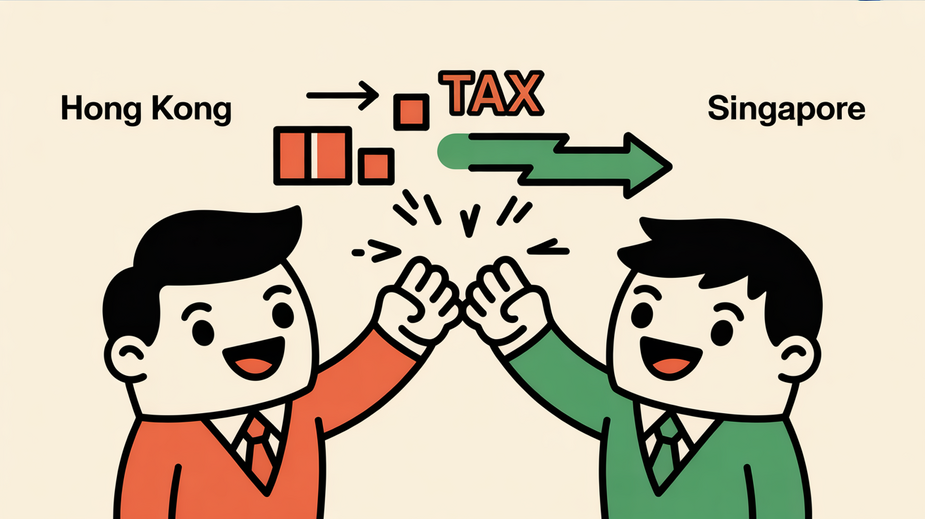

Navigating Cross-Border Investment: A Deep Dive into the HK-Singapore DTA The Double Taxation Agreement (DTA)......

Understanding Hong Kong’s Offshore IP Tax Policy Hong Kong’s taxation system is founded on the......

📋 Key Facts at a Glance Automatic Extension: eTAX's Individual Tax Portal provides automatic one-month......

Hong Kong's Tax Framework for Rental Income Effectively managing rental properties in Hong Kong requires......

📋 Key Facts at a Glance No Capital Gains Tax: Hong Kong does not tax......

📋 Key Facts at a Glance Critical Deadline: You must file a written objection within......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308