Hong Kong's Tax Landscape for Digital Commerce Hong Kong operates under a fundamental and distinct......

📋 Key Facts at a Glance Property Tax Rate: 15% on net assessable value (rental......

📋 Key Facts at a Glance Two-Tier Profits Tax: 8.25% on first HK$2 million, 16.5%......

Understanding Hong Kong's Double Tax Treaty Network Hong Kong boasts a wide and expanding network......

Understanding Double Taxation Treaty Fundamentals in Hong Kong Double Taxation Treaties (DTTs), known in Hong......

Purpose and Scope of the HK-UK Tax Treaty The Double Taxation Relief Agreement (DTRA) between......

📋 Key Facts at a Glance Tax-Neutral Rollovers: MPF transfers between approved schemes are tax-free......

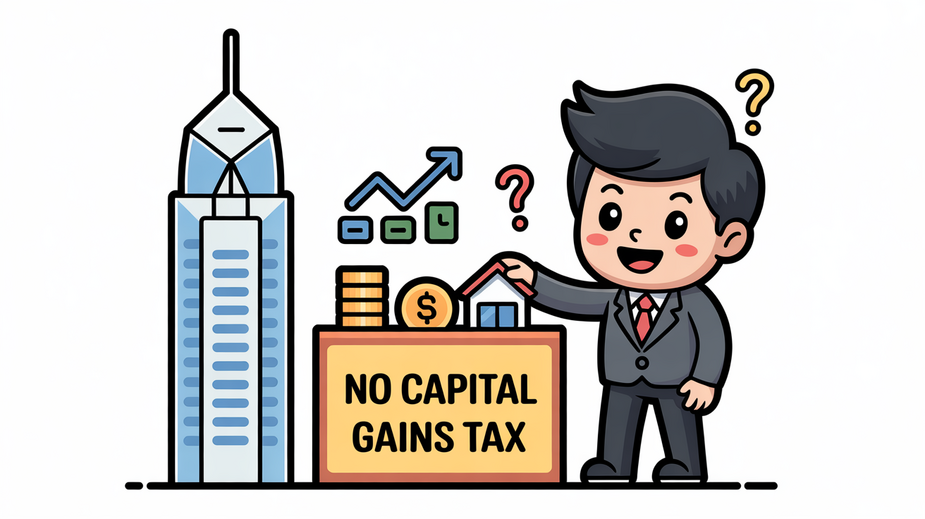

Understanding Hong Kong's Capital Gains Tax Framework Hong Kong's tax system is widely recognized for......

📋 Key Facts at a Glance Two-Tier Profits Tax: 8.25% on first HK$2 million, 16.5%......

📋 Key Facts at a Glance Global Minimum Tax: 15% minimum effective tax rate for......

📋 Key Facts at a Glance 15% IIT Cap: Hong Kong residents working in the......

Understanding the HK-India Tax Treaty Framework The Double Taxation Avoidance Agreement (DTAA) between Hong Kong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308