📋 Key Facts at a Glance Territorial Taxation: Only Hong Kong-sourced income is taxable; offshore......

Hong Kong's Territorial Tax System Explained A cornerstone of Hong Kong's appeal as a global......

📋 Key Facts at a Glance Introduction Date: LPF regime commenced 31 August 2020 under......

Understanding Income Splitting in Hong Kong Income splitting, as applied within Hong Kong's tax framework,......

📋 Key Facts at a Glance Tax System Fundamentals: Hong Kong operates a territorial tax......

📋 Key Facts at a Glance Legal Foundation: Electronic Transactions Ordinance (Cap. 553) grants digital......

📋 Key Facts at a Glance Filing Deadline: Within 1 month of receiving BIR56A (typically......

Understanding Joint Tenancy vs. Tenancy in Common in Hong Kong When acquiring property with another......

📋 Key Facts at a Glance Territorial Tax System: Only Hong Kong-sourced profits are taxable,......

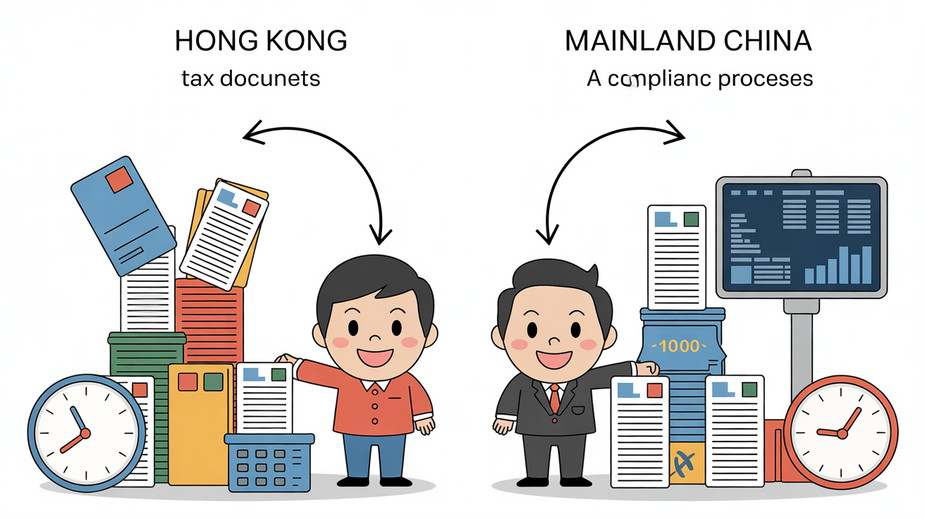

Eligibility Criteria for Overseas Tax Deductions Understanding the specific eligibility criteria is a fundamental step......

The High Stakes of Family Business Transitions in Hong Kong Family-owned enterprises are integral to......

📋 Key Facts at a Glance Zero Capital Gains Tax: Investment profits from stocks, property,......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308