📋 Key Facts at a Glance Equity Stamp Duty Rate: 0.1% per party (0.2% total)......

Hong Kong’s Corporate Tax Framework: Separate Entity Principle vs. Consolidated Options Hong Kong operates under......

Navigating Hong Kong's Salaries Tax: A Comprehensive Guide Understanding Hong Kong's Salaries Tax system is......

Hong Kong's Tax Landscape for Retirement Planning Hong Kong offers a distinct and often advantageous......

📋 Key Facts at a Glance Extended Timelines: Hong Kong tax disputes can span 1-5+......

📋 Key Facts at a Glance Strict One-Month Deadline: You have exactly 30 days from......

📋 Key Facts at a Glance Computerized Risk Assessment: The IRD uses sophisticated "Assess First......

Hong Kong's Tax Benefits for Single-Family Offices vs. Multi-Family Offices Key Facts: Hong Kong Family......

Basics of Hong Kong Provisional Tax Provisional tax in Hong Kong functions as an advance......

📋 Key Facts at a Glance Criminal Penalties: Up to 3 years imprisonment plus HK$50,000......

Understanding Hong Kong's Property Tax Framework Hong Kong's property tax system is a fundamental aspect......

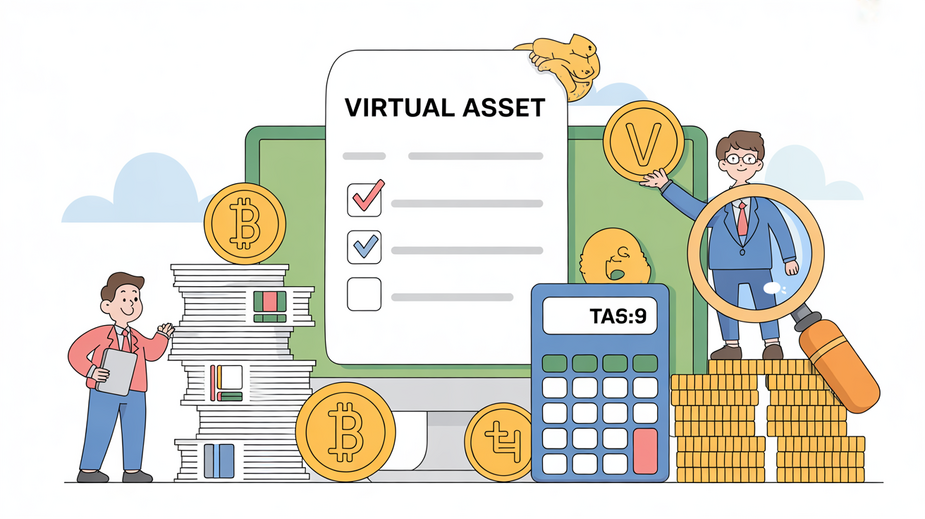

Defining Taxable Activities for VASPs For Virtual Asset Service Providers (VASPs) operating in Hong Kong,......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308