Defining Deductible Professional Fees in Hong Kong Understanding what constitutes a deductible professional fee is......

Hong Kong's Territorial Tax System Explained Hong Kong distinguishes itself globally through its territorial basis......

📋 Key Facts at a Glance Investigation Powers: The IRD has extensive statutory powers under......

Hong Kong’s Foundational Legal Framework for Asset Protection Hong Kong's legal system, deeply rooted in......

📋 Key Facts at a Glance Hong Kong's DTA Network: 45+ comprehensive double taxation agreements......

📋 Key Facts at a Glance Standard Property Rate: 5% of rateable value applies to......

Core Principles of HK-China Transfer Pricing Rules Effective navigation of the transfer pricing landscape between......

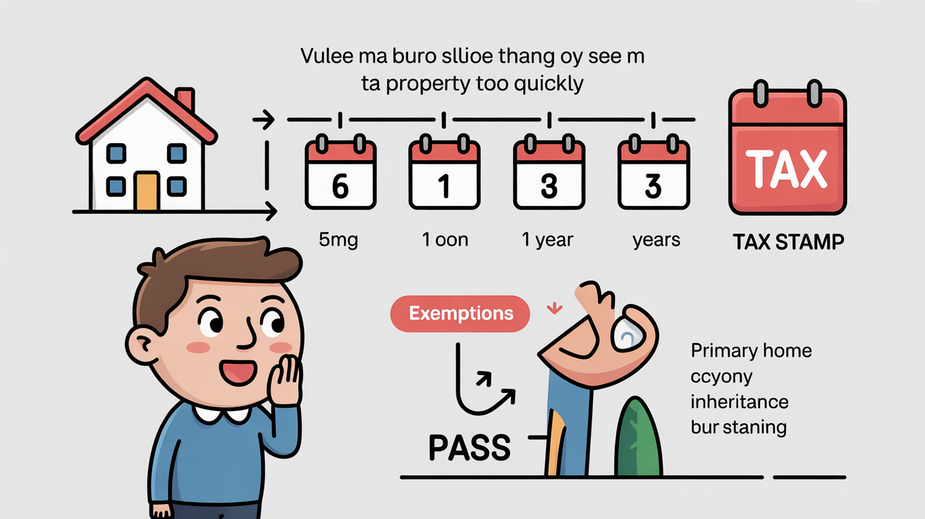

📋 Key Facts at a Glance Complete Abolition: Special Stamp Duty (SSD) was abolished on......

Hong Kong's Territorial Tax System Explained Hong Kong operates under a territorial basis of taxation,......

Unlocking Tax Savings: Overlooked Operational Expenses for Hong Kong SMEs Navigating the complexities of tax......

📋 Key Facts at a Glance Proactive internal audits reduce IRD audit risk by 70%+:......

Understanding Hong Kong's Profits Tax Framework Navigating business taxation is a fundamental aspect for small......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308