Understanding Your Salaries Tax Assessment Notice Receiving your Hong Kong Salaries Tax assessment notice from......

Real Estate vs. Equities: Which Offers Better Tax Efficiency in Hong Kong? Real Estate vs.......

Understanding Hong Kong Salaries Tax: Source vs. Residency Navigating Salaries Tax in Hong Kong requires......

Why Transfer Pricing Matters in Hong Kong Hong Kong has long held a prominent position......

The Ultimate Guide to Tax-Deductible Donations for Hong Kong-Based Companies The Ultimate Guide to Tax-Deductible......

Key Facts Dual GAAR System: Hong Kong operates two General Anti-Avoidance Rules under Sections 61......

Key Facts: Currency Exchange and Hong Kong Property Tax Property tax rate: 15% of net......

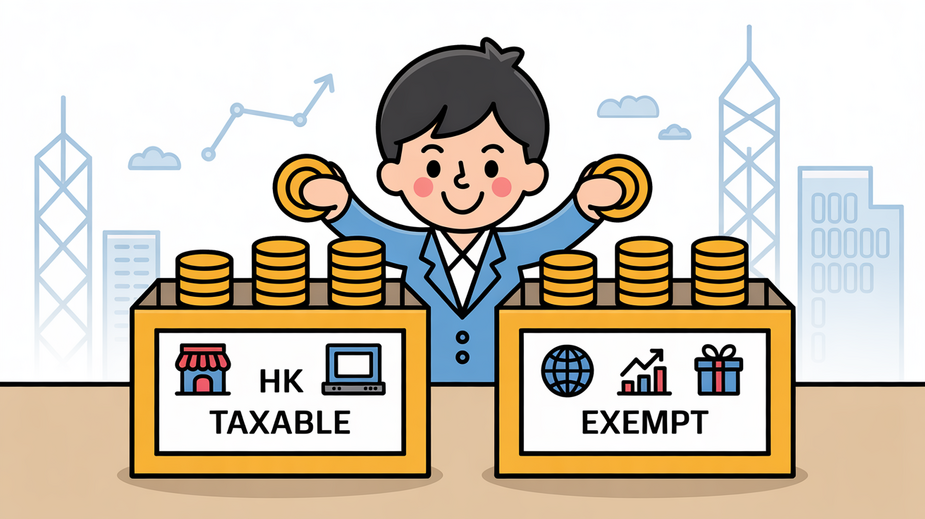

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

How to Leverage Hong Kong's Tax Treaties for Cross-Border Investment Gains Key Facts: Hong Kong's......

Key Facts: Hong Kong Tax Dispute Resolution Trends BEPS 2.0 Implementation: Hong Kong enacted Pillar......

Hong Kong's Capital Gains Tax Exemption: Myths and Realities for Investors Key Facts: Hong Kong......

Key Facts: Hong Kong Stock Stamp Duty for Foreign Investors Current Rate: 0.1% per party......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308