Navigating IRD Notifications: Types, Formats, and Initial Steps Receiving correspondence from the Hong Kong Inland......

Essential Tax Deductions for Hong Kong Taxpayers Navigating the intricacies of personal income tax in......

Global Drivers of Supply Chain Restructuring The global business environment is undergoing significant transformation, compelling......

Understanding VAT and GST-Free Fundamentals Navigating the complexities of international trade requires a clear understanding......

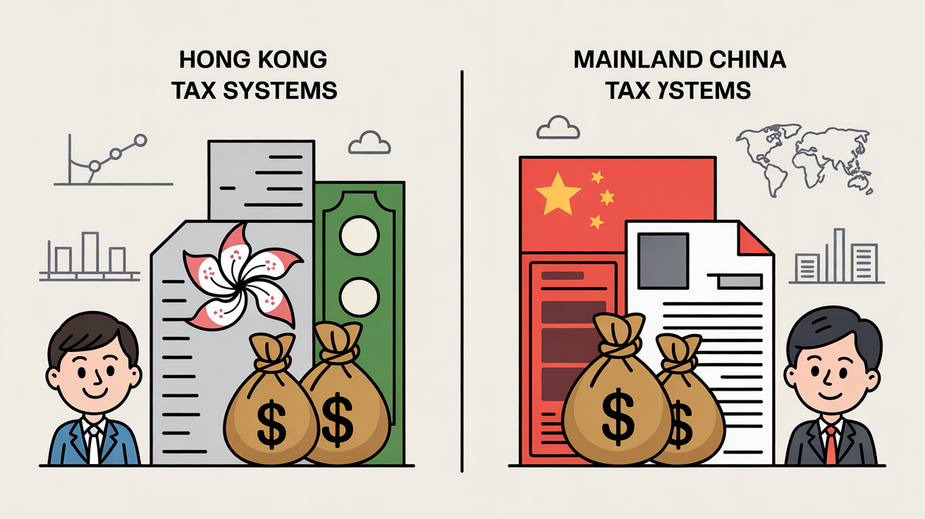

Understanding Hong Kong-Mainland Tax Jurisdiction Differences Establishing a joint venture between Hong Kong and Mainland......

Tax Residency Definitions and Scope Navigating the tax landscape as a non-resident entrepreneur operating within......

BEPS 2.0: Fundamentals for Global Businesses The Base Erosion and Profit Shifting (BEPS) 2.0 initiative,......

Understanding Hong Kong's Territorial Tax System Navigating the tax landscape in Hong Kong fundamentally relies......

Understanding Hong Kong's Capital Gains Tax Framework Hong Kong is renowned globally as an attractive......

Understanding Statutory Deadlines for Tax Appeals in Hong Kong Successfully navigating the tax appeal process......

Strategic Tax Advantages for Cross-Border Innovation The Double Taxation Agreement (DTA) between Hong Kong and......

Cryptocurrency Classification Under Hong Kong Law Hong Kong adopts a specific and crucial stance on......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308