香港の関税免除制度の活用:輸入業者のための戦略的ガイド

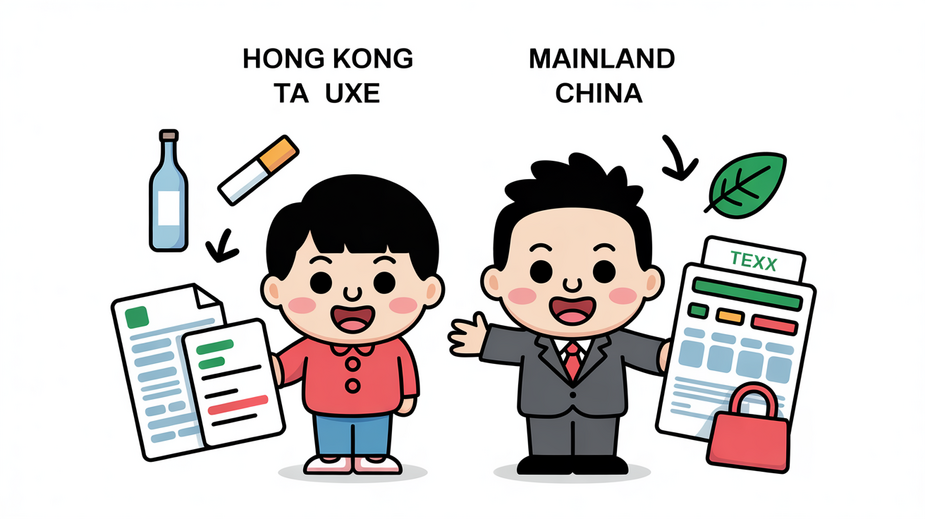

📋 ポイント早見 自由港の地位: 香港は輸入品の99%に関税を課さず、VATやGSTもありません。 課税対象の4品目: 酒類(アルコール度数30%超)、タバコ、炭化水素油、メチルアルコールのみが物品税の対象です。 ワインの優位性: ワインとビールは2008年より免税となり、香港はアジア随一のワイン取引ハブとなっています。 CEPAの恩恵: 香港産品は、中国本土の14億人の消費市場へのゼロ関税アクセスを享受できます。 申告要件: 1,000香港ドル超の貨物には輸入申告が義務付けられ、到着後14日以内に提出する必要があります。 電子申告: 1,000香港ドル超の貨物に関するすべての申告は、電子提出が必須です。 世界有数の貿易ハブに商品を輸入する際、99%の品目が関税ゼロ、付加価値税なし、手続きも簡素化されていると想像してみてください。これは仮定の話ではなく、香港でビジネスを行う現実です。世界で数少ない真の自由港の一つとして、香港は輸入業者に比類のないコスト優位性と運営の柔軟性を提供しています。アジア太平洋のサプライチェーンを最適化する多国籍企業であれ、越境ECを模索するスタートアップであれ、香港の関税免除制度を理解することは、輸入戦略と収益性を大きく変える可能性があります。 香港の自由港としての優位性:グローバル貿易のゲートウェイ 香港の自由港としての地位は、単なる歴史的な脚注ではなく、今も世界中の貿易を惹きつけ続ける生きた競争優位性です。包括的な関税を課す多くの管轄区域とは異なり、香港は非常に自由化された貿易体制を維持しています。一般輸入品に対する関税はなく、関税割当、付加税もなく、決定的に、付加価値税(VAT)や物品サービス税(GST)の制度もありません。これにより、輸入業者は累積的な税負担を気にすることなく、世界中から商品を持ち込むことができる独特の環境が生まれています。 💡 専門家のヒント: 香港を地域の集荷・仕分けハブとして活用しましょう。アジアの複数のサプライヤーからの貨物を集約し、品質検査を実施し、最終目的地へ配送するまでの一連の工程を、香港に一時的に留まる商品に対して輸入関税を支払うことなく行えます。 何が本当に免税なのか?99%ルールの詳細 広範な関税免除は、想像しうるほぼすべての商品カテゴリーをカバーしています。以下は香港に完全に免税で輸入される品目の例です: 家電・電子機器: スマートフォン、ノートパソコン、タブレット、全ての技術製品 産業用設備: 製造機械、工具、生産ライン