📋 Key Facts at a Glance Pillar Two Global Minimum Tax: Enacted June 6, 2025......

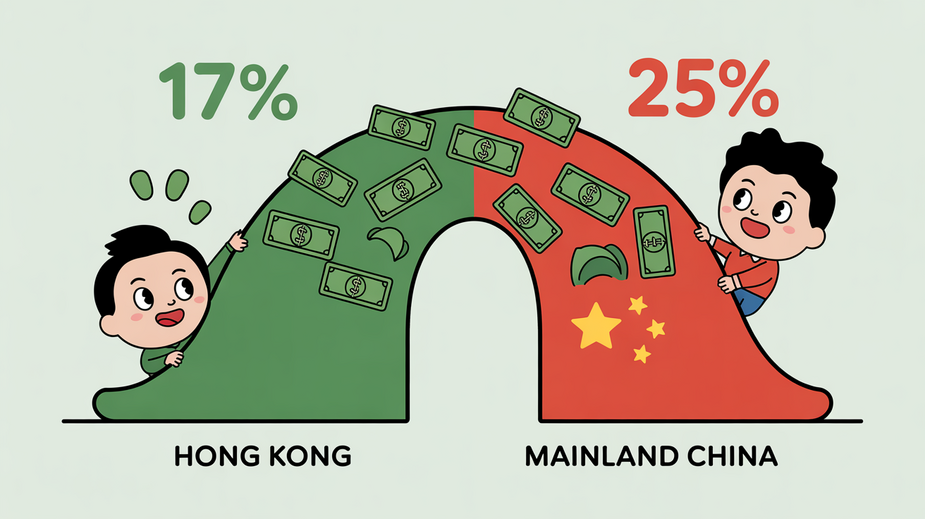

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

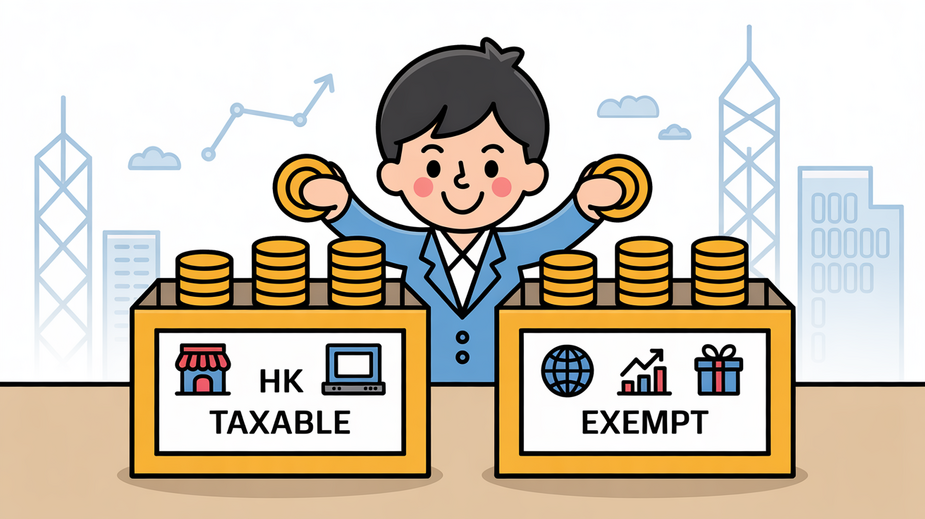

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

BEPS Impact on Hong Kong’s Tax Framework The OECD's Base Erosion and Profit Shifting (BEPS)......

Understanding Hong Kong’s Salaries Tax System: Progressive vs. Standard Rates Hong Kong’s Salaries Tax system......

📋 Key Facts at a Glance Global Minimum Tax: 15% minimum effective tax rate for......

Understanding Hong Kong Tax Residency for Foreign Entrepreneurs For foreign entrepreneurs operating or residing in......

📋 Key Facts at a Glance Free Port Status: Hong Kong imposes no tariffs, quotas,......

📋 Key Facts at a Glance Hong Kong Stock Stamp Duty: 0.1% per party (0.2%......

Tax Residency Definitions and Implications Understanding where you are considered a tax resident is the......

Hong Kong's Capital Gains Tax Stance Explained Hong Kong operates under a territorial principle of......

Understanding Wills in Hong Kong's Legal Framework Establishing a valid will in Hong Kong is......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308