Understanding Hong Kong's Two-Tiered Profits Tax Structure Hong Kong's implementation of a two-tiered profits tax......

Hong Kong Tax Calendar Essentials Navigating the tax landscape in Hong Kong begins with a......

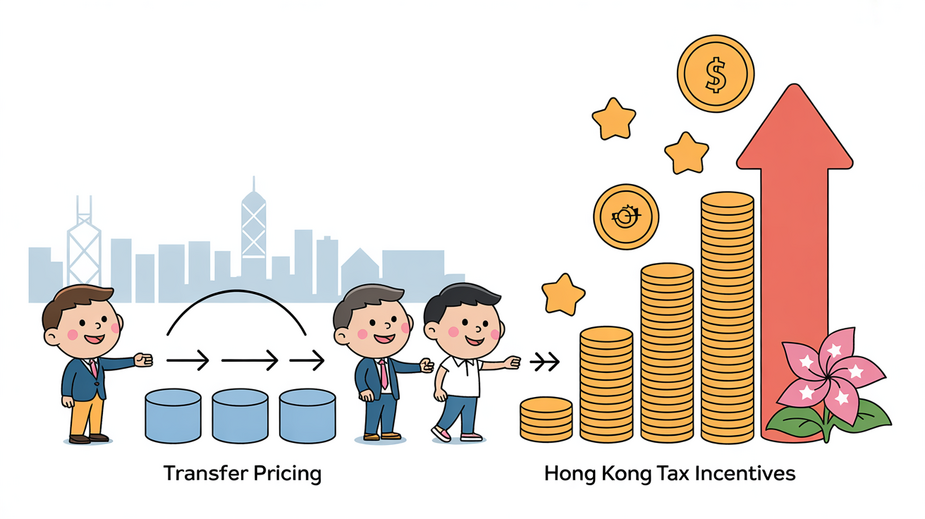

Transfer Pricing and Hong Kong Tax Optimization In today's interconnected global economy, multinational enterprises operating......

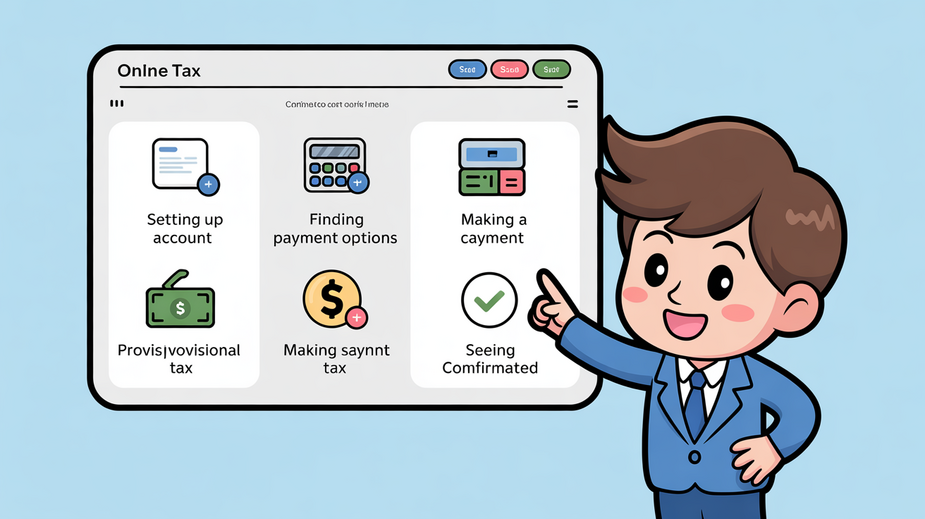

How to Use Hong Kong's eTAX Portal for Provisional Tax Payments Key Facts: Hong Kong......

Key Facts: Hong Kong Fintech Tax Compliance 2025 Two-Tier Profits Tax: 8.25% on first HK$2......

Key Facts: Strategic Sourcing and Customs Duties Hong Kong Free Port Status: Hong Kong does......

Understanding VAT and GST-Free Fundamentals Navigating the complexities of international trade requires a clear understanding......

Key Facts: Hong Kong Property Tax for Foreign Investors Standard Property Tax Rate: 15% on......

Comparing Hong Kong's Tax Transparency with OECD Global Standards Comparing Hong Kong's Tax Transparency with......

Tax-Efficient Exit Strategies: Selling Your Hong Kong Business Without the Heavy Tax Burden Tax-Efficient Exit......

Core Mechanics of Hong Kong Limited Partnerships Understanding the foundational structure of a Hong Kong......

Hong Kong's Territorial Principle of Taxation Hong Kong employs a territorial basis for taxation, a......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308