Core Mechanics of Double Tax Relief Navigating international commerce often involves the risk of the......

Mastering Hong Kong Salaries Tax: A Guide to Avoiding Common Mistakes Navigating the intricacies of......

Understanding Taxable Rental Income Sources in Hong Kong For small and medium-sized enterprises (SMEs) in......

Current Market Snapshots: Price Per Square Foot Understanding the property landscape in Hong Kong and......

DTA Networks: Scope and Global Reach Double Tax Avoidance (DTA) treaties are essential tools for......

Navigating Hong Kong's 2024 Tax Relief Landscape for SMEs Hong Kong's 2024 budget introduces significant......

Understanding Hong Kong's Stock Transaction Tax Hong Kong's financial market involves various transaction costs, among......

Understanding Capital Allowances in Hong Kong Navigating business finances effectively requires a clear understanding of......

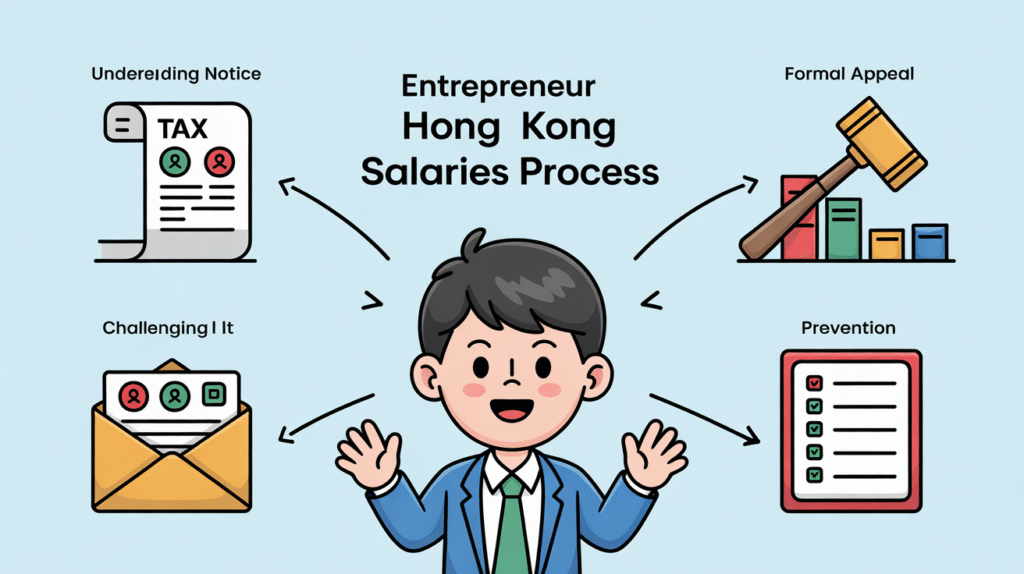

Understanding Your Salaries Tax Assessment Notice Receiving your Hong Kong Salaries Tax assessment notice from......

Why Hong Kong Attracts Tax-Conscious Expats Hong Kong has long been celebrated as a highly......

Private Foundations: A Pillar of Modern Wealth Preservation in Hong Kong In the evolving landscape......

Understanding Hong Kong's Territorial Tax Framework and Offshore Exemption Hong Kong's tax system operates on......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308