Hong Kong's Favorable Property Tax Regime for Rental Income Hong Kong is widely recognized as......

Hong Kong’s Unique Tax Framework Explained Hong Kong distinguishes itself globally with a notably straightforward......

Hong Kong's Evolving Approach to Digital Asset Regulation and Tax Hong Kong is proactively establishing......

Hong Kong's Flourishing Fintech Ecosystem and Regulatory Landscape Building upon its foundation as a premier......

Eligibility Criteria for Marriage-Based Tax Benefits in Hong Kong Accessing the tax benefits available to......

Understanding BEPS and Its Global Implications The Base Erosion and Profit Shifting (BEPS) project, led......

Hong Kong's Integrated Approach to ESG and Tax Policy Hong Kong is strategically developing its......

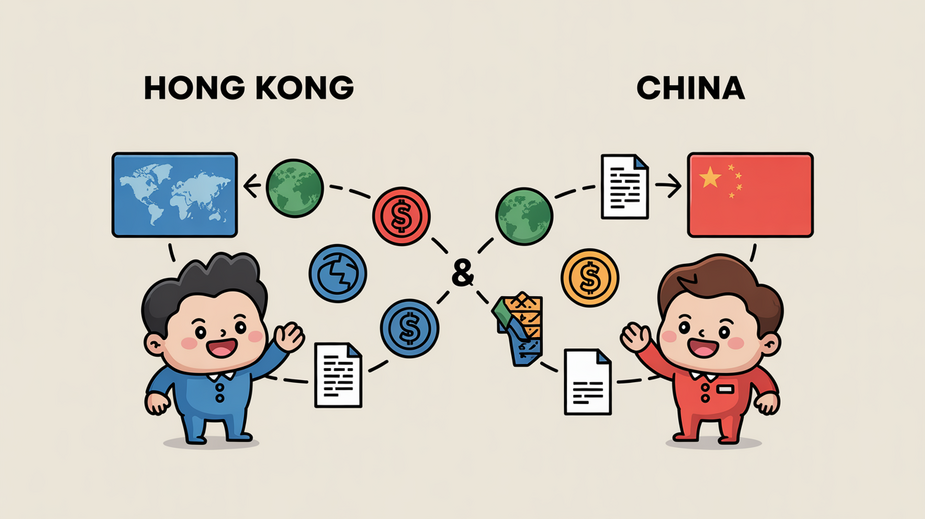

Navigating Tax Differences: Hong Kong's Territorial vs. Mainland China's Progressive System Understanding the fundamental differences......

Initial Tax Obligations: Rent vs. Sale of Hong Kong Property Choosing whether to rent out......

Hong Kong's Tax Landscape for Retirement Planning Hong Kong offers a distinct and often advantageous......

DTA Networks: Scope and Global Reach Double Tax Avoidance (DTA) treaties are essential tools for......

Understanding Hong Kong's Transfer Pricing Framework For foreign businesses operating in Hong Kong, a clear......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308