Critical Documentation Red Flags in Audits In the landscape of tax compliance, thorough and accurate......

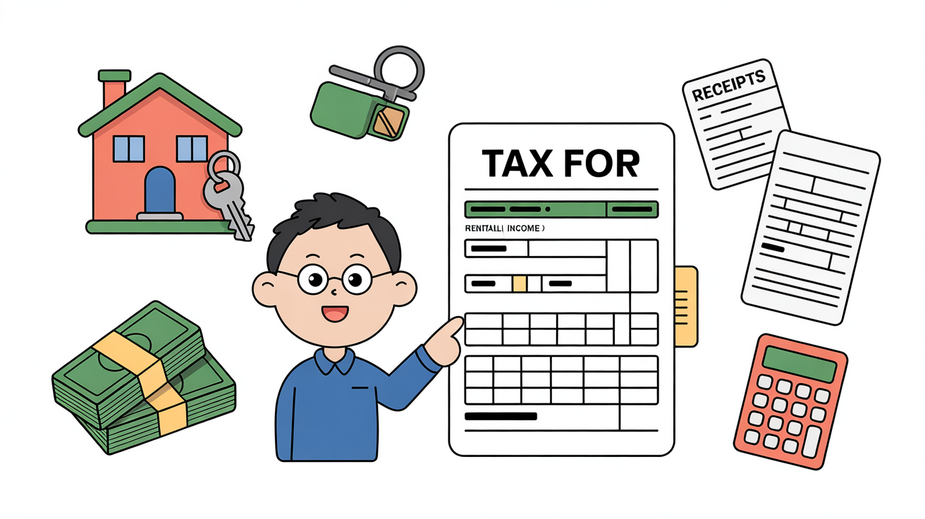

Hong Kong Property Tax Basics for Owners Understanding the fundamental aspects of Hong Kong's Property......

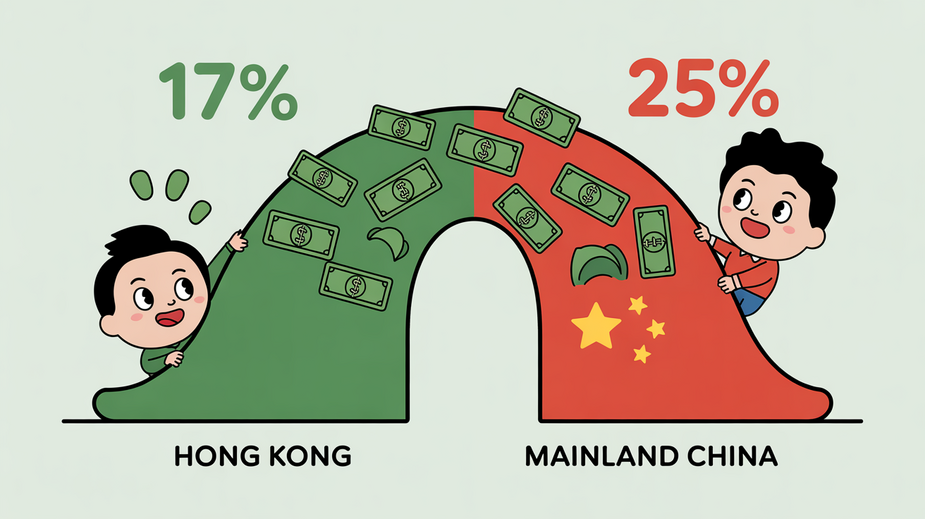

Understanding Hong Kong’s Two-Tiered Tax Structure Hong Kong distinguishes itself with a competitive two-tiered profits......

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

Understanding Hong Kong’s Double Tax Treaty Network Double Tax Treaties (DTTs) are crucial international agreements......

Hong Kong's Strategic Tax Treaty Network Hong Kong has strategically cultivated an extensive network of......

Understanding Depreciation Allowances: A Core Tax Shield In the landscape of business finance, particularly within......

Understanding Hong Kong’s Tax Framework for Expats Navigating retirement planning as an expat in Hong......

What Qualifies as Rental Income in Hong Kong Understanding precisely what constitutes taxable rental income......

Understanding Tax Nexus in Hong Kong's Digital Economy For businesses operating internationally, particularly in the......

Understanding Hong Kong's Excise Duty Framework Hong Kong operates a focused excise duty system, distinct......

Recent Amendments to Tax Residency Requirements in Hong Kong Hong Kong's Inland Revenue Department (IRD)......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308