Navigating Hong Kong's Tax Documentation Essentials Understanding and adhering to Hong Kong's tax documentation standards......

Understanding Hong Kong's Tax System Structure Navigating the tax landscape is fundamental for residents and......

Digital Tax Compliance in Hong Kong: Preparing for Global Reporting Standards Digital Tax Compliance in......

Key Facts: Serviced Apartments Tax Treatment in Hong Kong Tax Classification: Serviced apartments may be......

Key Facts: Hong Kong-China Double Tax Relief CDTA Effective Date: Arrangement signed 21 August 2006;......

Key Facts About Hong Kong Customs Clearance Free Port Status: Hong Kong does not levy......

Hong Kong's Tax Benefits for Single-Family Offices vs. Multi-Family Offices Key Facts: Hong Kong Family......

Key Facts: Hong Kong Stock Trading Costs Stamp Duty: 0.1% per party (0.2% total) -......

MPF vs Traditional Pension Plans: Key Differences Understanding the nature of your retirement savings scheme......

Key Facts: Hong Kong Cryptocurrency Taxation & Regulation No Capital Gains Tax: Profits from long-term......

Hong Kong's Tax System: Key Features for Expats Hong Kong offers a remarkably straightforward and......

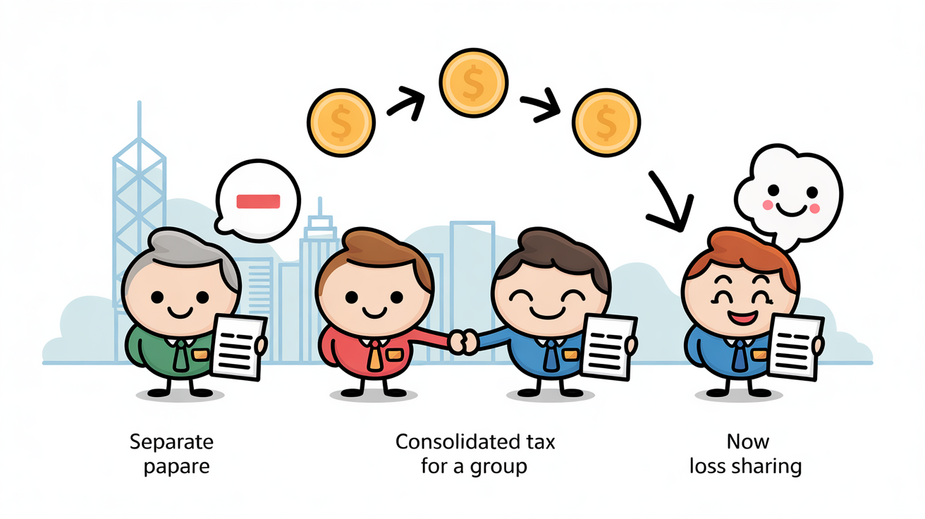

Hong Kong’s Corporate Tax Framework: Separate Entity Principle vs. Consolidated Options Hong Kong operates under......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308