Leveraging Hong Kong's Territorial Tax Principle Hong Kong's tax system operates on a fundamental territorial......

Mainland Economic Activities and Tax Presence A company registered in Hong Kong may establish a......

Understanding Non-Resident Director Status and Hong Kong Tax Navigating tax reporting obligations in Hong Kong......

Hong Kong's Tax Landscape and Wealth Preservation Needs Hong Kong is renowned for its appealing......

Understanding BEPS and Its Global Impact Base Erosion and Profit Shifting (BEPS) refers to sophisticated......

Asia's Leading Wealth Hubs Vie for Prominence The landscape of global wealth management is undergoing......

Understanding Hong Kong's Tax System Structure Navigating the tax landscape is fundamental for residents and......

Hong Kong’s Tax Environment for Investors Hong Kong's tax system is fundamentally based on the......

Navigating Hong Kong's eTAX System for Freelancers Hong Kong's eTAX system serves as the official......

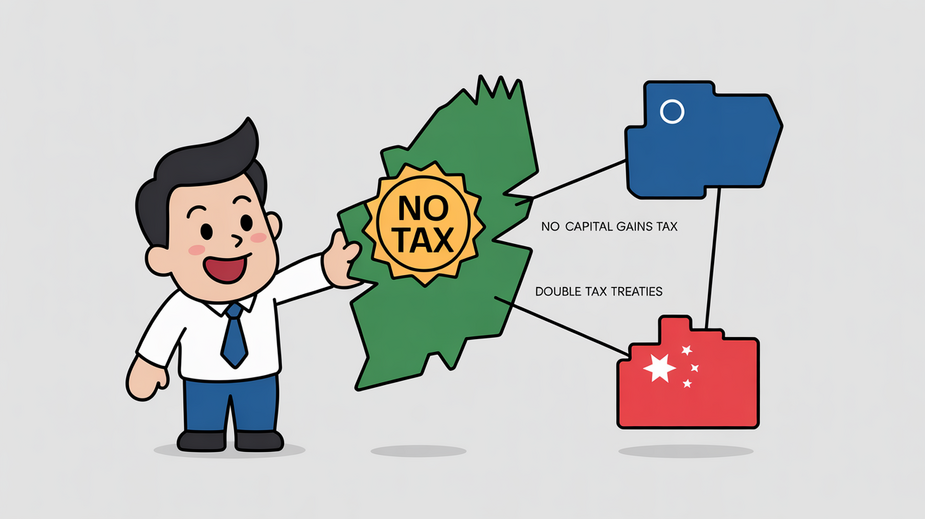

Hong Kong as a Premier Holding Company Jurisdiction: A Tax-Focused Analysis Hong Kong is widely......

Hong Kong's Approach to Taxing Capital Gains Hong Kong operates under a territorial basis of......

Understanding Hong Kong Tax Audit Triggers Preparing for a potential tax audit by the Hong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308