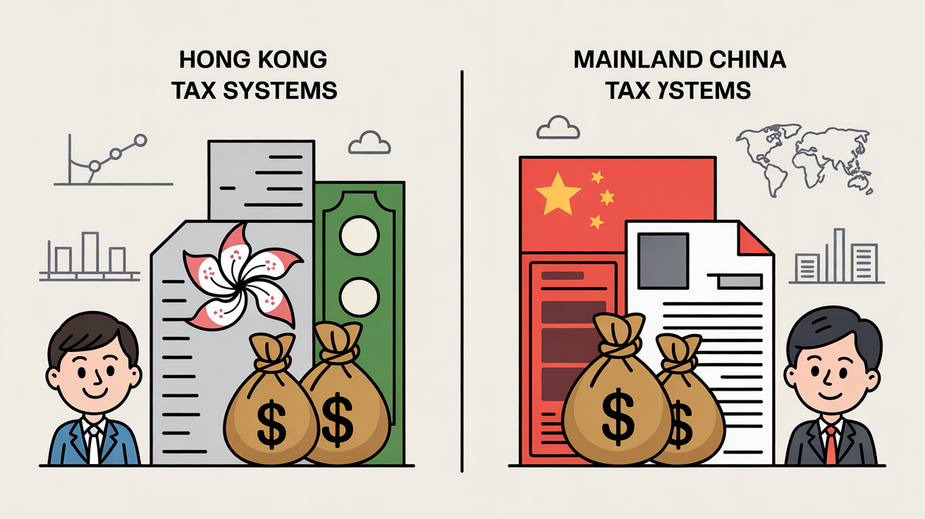

Understanding Hong Kong-China Cross-Border Taxation Operating a business across the distinct tax jurisdictions of Hong......

Profits Tax Fundamentals for Hong Kong Businesses Operating a business in Hong Kong requires a......

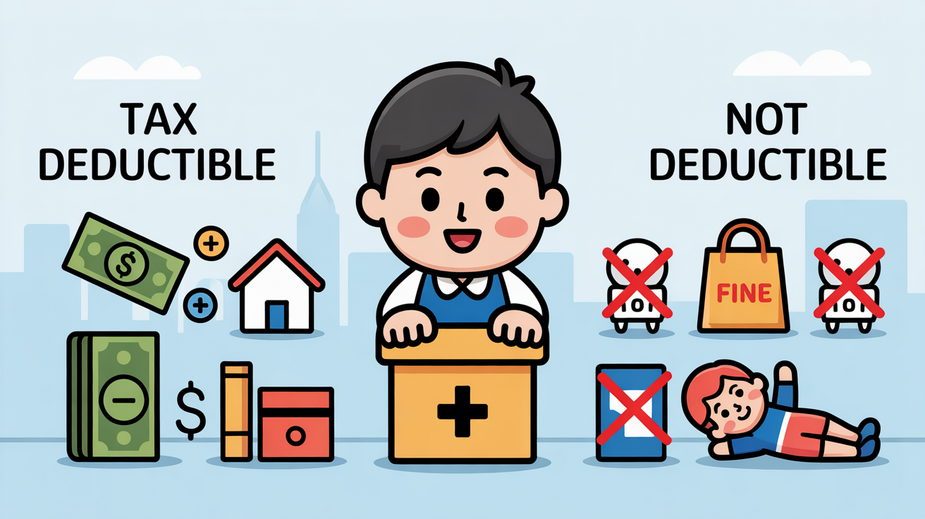

Understanding Hong Kong's Education Tax Relief Framework Hong Kong's tax system provides specific provisions offering......

Maximizing Tax Savings: A Guide to Hong Kong Tax Deductions and Allowances Understanding the intricacies......

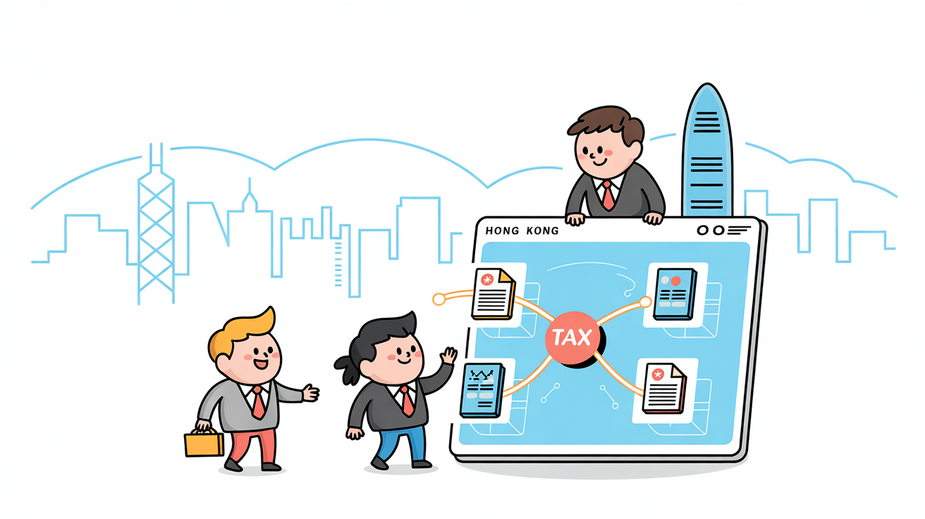

Understanding Hong Kong's Tax Digitalization Framework Hong Kong's Inland Revenue Department (IRD) has significantly advanced......

The Evolution of Transfer Pricing in Hong Kong Transfer pricing within Hong Kong's tax landscape......

Understanding Stamp Duty in Hong Kong Markets Stamp duty represents a significant transactional cost and......

Understanding Hong Kong's Profits Tax Framework Navigating business taxation is a fundamental aspect for small......

Tax Residency Definitions and Scope Navigating the tax landscape as a non-resident entrepreneur operating within......

Understanding Digital Signatures in Hong Kong's eTAX System When interacting with Hong Kong's eTAX system......

```html Understanding Hong Kong's Deduction Framework Navigating personal tax deductions in Hong Kong requires a......

Understanding Customs Duty Drawback in Hong Kong Customs duty drawback in Hong Kong serves as......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308