Understanding Estate Freezing Fundamentals Estate freezing is a strategic estate planning technique designed to limit......

Key Facts: Hong Kong Stamp Duty and Green Buildings Current Stamp Duty: Ad Valorem Stamp......

Understanding Hong Kong’s Two-Tiered Tax Structure Hong Kong distinguishes itself with a competitive two-tiered profits......

The Protector Role in Hong Kong Trust Structures: Oversight and Governance Within the sophisticated landscape......

Legal Rights and Obligations During a Hong Kong Tax Investigation Legal Rights and Obligations During......

Withholding Tax Obligations in Hong Kong: Clarifying Common Misconceptions Withholding Tax Obligations in Hong Kong:......

Addressing Cross-Border Tax Complexities for a Global Entrepreneur International expansion presents significant opportunities for thriving......

Understanding BEPS Actions 8-10: Aligning Profit with Value Creation The Organisation for Economic Co-operation and......

Why SME Training Investments Pay Double Dividends in Hong Kong For Hong Kong's Small and......

Key Facts The IRD uses an "assess first, audit later" approach with no fixed audit......

Understanding Hong Kong Profits Tax Assessments Receiving a profits tax assessment from the Inland Revenue......

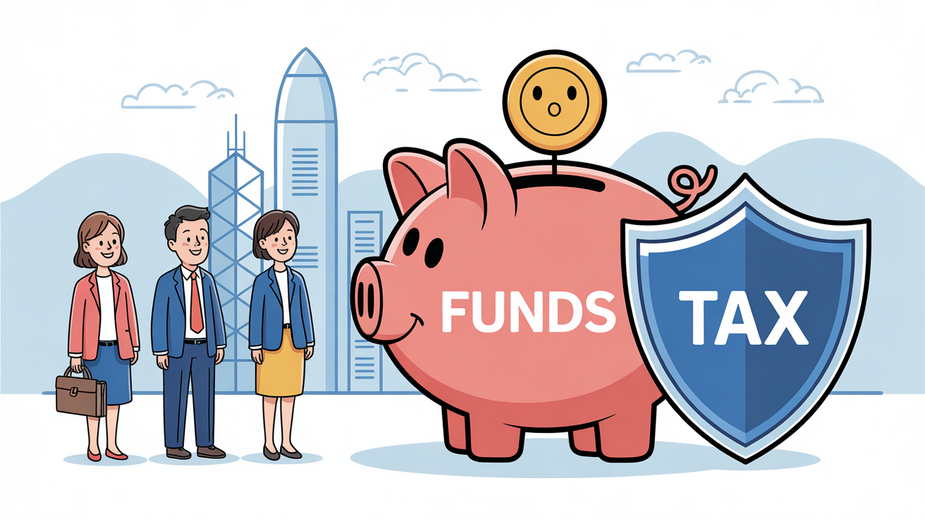

Hong Kong's Tax Treatment of Family Office Investment Funds: What You Need to Know Hong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308