Hong Kong’s Territorial Tax System Explained Hong Kong operates a distinct territorial basis of taxation,......

📋 Key Facts at a Glance Treaty Name: Arrangement between Mainland China and Hong Kong......

Understanding Hong Kong’s Charitable Tax Deduction Framework Hong Kong's tax system is designed to actively......

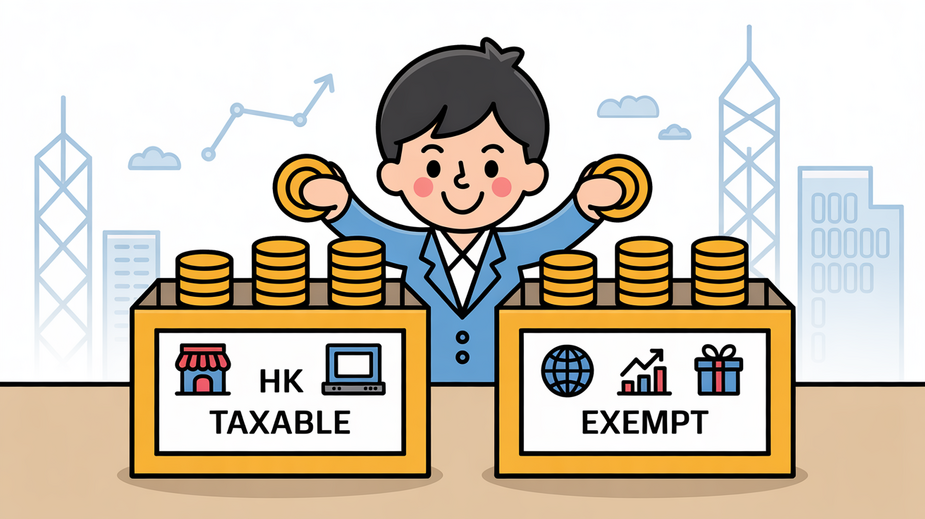

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

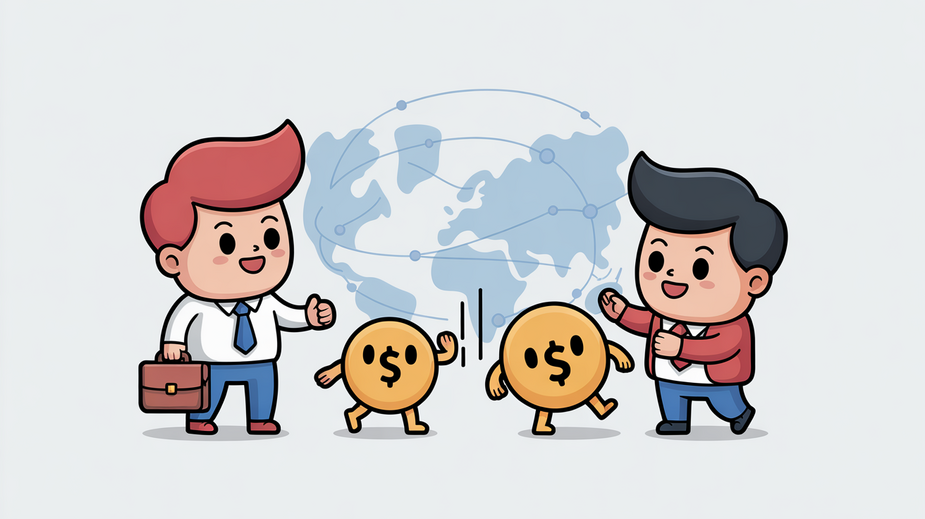

Understanding Double Taxation Risks in Global Business Navigating the international business landscape offers significant opportunities......

📋 Key Facts at a Glance Corporate Tax Rates: 8.25% on first HK$2 million, 16.5%......

Key Tax Reform Announcements in 2024 Hong Kong's tax landscape is embarking on a significant......

📋 Key Facts at a Glance Maximum Deduction: 35% of assessable profits under Section 16D......

📋 Key Facts at a Glance Legal Foundation: Hong Kong's trust framework is based on......

Understanding Hong Kong's Corporate Tax Framework Navigating the complexities of corporate taxation in Hong Kong......

📋 Key Facts at a Glance Property Rates: 5% of Rateable Value (RV) annually Government......

📋 Key Facts at a Glance Automatic Extension: eTAX filers receive an automatic 1-month filing......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308