📋 Key Facts at a Glance Zero Capital Gains Tax: Investment profits from stocks, property,......

📋 Key Facts at a Glance Profits Tax Advantage: Two-tier system: 8.25% on first HK$2M,......

📋 Key Facts at a Glance Territorial System: Only Hong Kong-sourced IP income is taxable......

📋 Key Facts at a Glance Hong Kong's System: Pure territorial taxation - only Hong......

📋 Key Facts at a Glance Territorial System: Hong Kong only taxes income sourced in......

📋 Key Facts at a Glance Tax-Free Death Benefits: Life insurance payouts in Hong Kong......

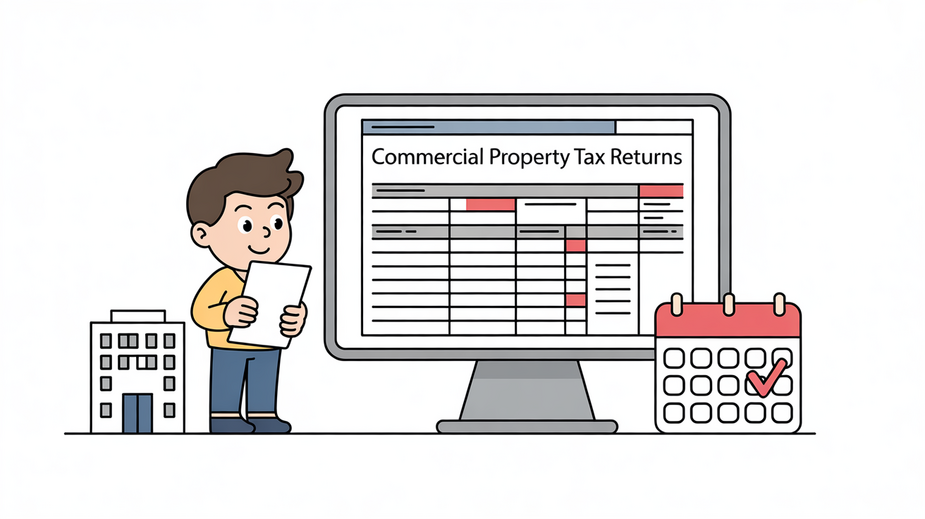

Understanding Hong Kong's Commercial Property Tax Navigating the specifics of Hong Kong's property tax system......

📋 Key Facts at a Glance REIT Unit Transfer Exemption: Complete stamp duty exemption for......

Offshore vs. Onshore Business Structures in Hong Kong: A Detailed Guide Understanding the fundamental distinctions......

Understanding Tax Implications of Marriage in Hong Kong Entering into marriage significantly alters various aspects......

Hong Kong's Position in the Global Property Market Hong Kong stands as a prominent global......

Understanding Rental Durations and Tax in Hong Kong Navigating Hong Kong's property market as an......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308