Maintenance and Repair Challenges for Landlords Owning rental property in Hong Kong inevitably involves confronting......

Hong Kong's Taxable Compensation Categories In Hong Kong, understanding how various forms of remuneration, particularly......

Understanding Ancillary Property Rights in Hong Kong In Hong Kong's property landscape, while outright ownership......

Recent Amendments to Tax Residency Requirements in Hong Kong Hong Kong's Inland Revenue Department (IRD)......

Understanding Hong Kong's Capital Gains Tax Framework Individuals managing investments or operating within Hong Kong......

Hong Kong’s Fund Tax Exemption Framework Hong Kong stands as a prominent international financial centre,......

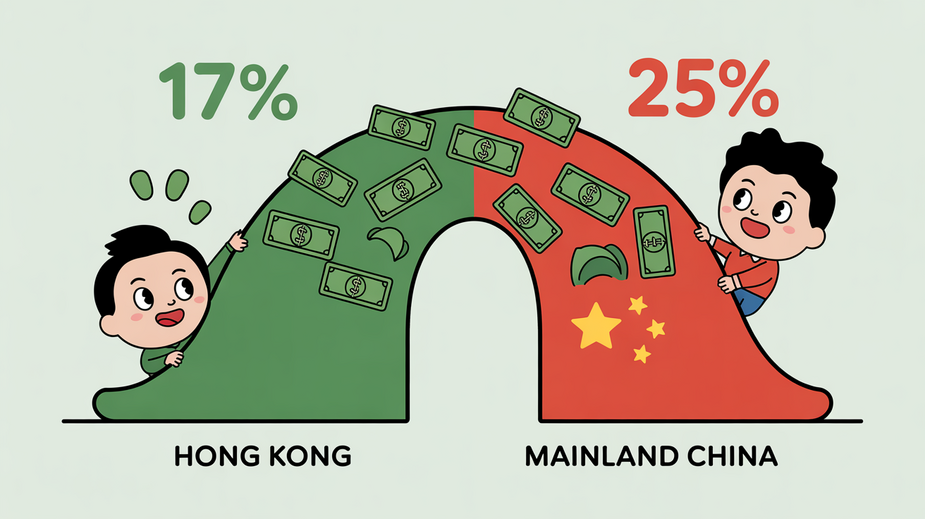

Understanding Hong Kong's Territorial Tax System One of the most fundamental aspects of filing a......

Hong Kong's Distinctive Territorial Tax System Hong Kong's enduring appeal as a strategic gateway for......

Core Principles of Hong Kong's Anti-Avoidance Tax Regulations Hong Kong's tax system, renowned for its......

Understanding Hong Kong's Enhanced R&D Tax Incentives Hong Kong has significantly bolstered its tax incentives......

Why Hong Kong Tax Disputes Require Specialized Expertise Hong Kong's dynamic position as a global......

Defining Heritage Buildings in Hong Kong Understanding what constitutes a heritage building in Hong Kong......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308