📋 Key Facts at a Glance Tax System: Territorial-based taxation – only Hong Kong-sourced profits......

Why Domicile Status Matters in Hong Kong Understanding your domicile status is fundamental for effective......

📋 Key Facts at a Glance Immediate 5% surcharge: Applied immediately on unpaid tax after......

Hong Kong's Retirement Tax Advantages for Global Employers Foreign companies considering or expanding their presence......

📋 Key Facts at a Glance Global Minimum Tax: Hong Kong enacted Pillar Two legislation......

Understanding Hong Kong's Property Tax Framework Hong Kong's property tax system is a fundamental element......

Strategic Value of the Hong Kong-Germany Double Taxation Agreement The economic relationship between Hong Kong......

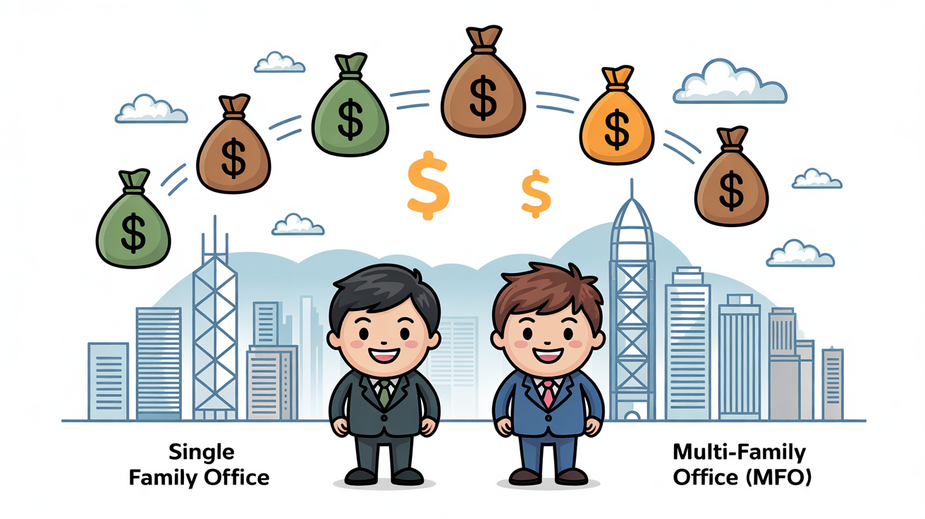

Hong Kong's Tax Benefits for Single-Family Offices vs. Multi-Family Offices Key Facts: Hong Kong Family......

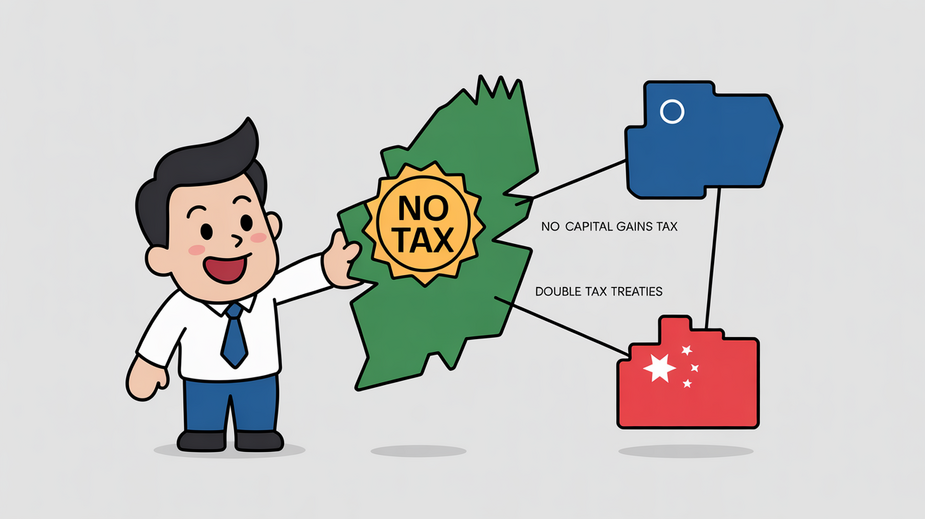

Understanding Hong Kong's Tax Treaty Network Hong Kong has cultivated an extensive and strategically important......

Hong Kong's Tax System Fundamentals for SMEs Understanding the foundational elements of Hong Kong's tax......

Global Tax Policy Shifts Reshaping Hong Kong The international tax landscape is currently undergoing a......

Hong Kong's Approach to Taxing Capital Gains Hong Kong operates under a territorial basis of......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308