Strategic Tax Advantages for Cross-Border Innovation The Double Taxation Agreement (DTA) between Hong Kong and......

Understanding Debt-to-Equity Conversion Mechanics A debt-to-equity conversion, often referred to as a debt-equity swap, serves......

📋 Key Facts at a Glance Two-Tiered Profits Tax: 8.25% on first HK$2 million, 16.5%......

📋 Key Facts at a Glance Two-Tier Profits Tax: 8.25% on first HK$2 million, 16.5%......

Hong Kong's Territorial Tax Principle Explained Hong Kong operates under a unique and highly competitive......

📋 Key Facts at a Glance Historic Policy Shift: All cooling measures (BSD, NRSD, SSD)......

📋 Key Facts at a Glance Stock Transfer Stamp Duty: Reduced to 0.1% per party......

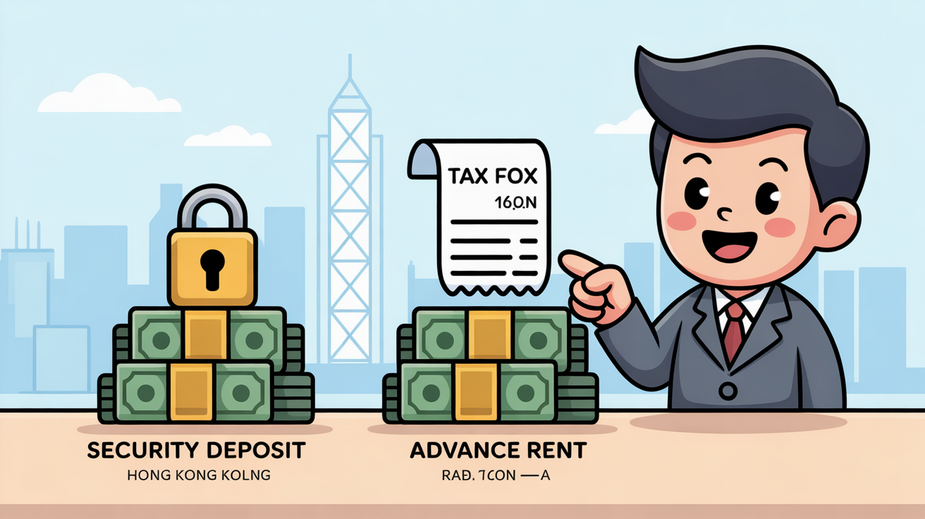

Understanding Security Deposits vs. Advance Rent in Hong Kong Taxation Navigating the tax landscape for......

Hong Kong's Tax Benefits for Single-Family Offices vs. Multi-Family Offices Key Facts: Hong Kong Family......

Understanding Hong Kong’s Core Tax Principles Hong Kong's tax system is renowned for its simplicity......

Hong Kong’s Distinct Tax Framework for Regional Operations Hong Kong stands as a leading international......

Understanding Hong Kong's Progressive Tax System Navigating the complexities of Hong Kong's salaries tax is......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308