Understanding Hong Kong's Unique Territorial Tax System Hong Kong's enduring prominence as a global financial......

Understanding the Dynasty Trust Structure A dynasty trust represents a sophisticated evolution in wealth planning,......

Offshore Income Classification Basics Understanding the fundamental distinction between offshore and onshore income is crucial......

BEPS 2.0 and the Two-Pillar Framework Explained The international tax landscape is undergoing a significant......

📋 Key Facts at a Glance Carbon Neutrality Target: Hong Kong aims for carbon neutrality......

Understanding Hong Kong Tax Residency Thresholds Determining your tax residency status is the critical first......

Defining Assessable Profits Under Hong Kong Law Navigating Hong Kong's corporate tax landscape begins with......

📋 Key Facts at a Glance 1-Month Deadline: All tax appeals in Hong Kong must......

📋 Key Facts at a Glance No Capital Gains Tax: Genuine art investors pay zero......

Understanding CRS & FATCA Reporting Obligations in Hong Kong Financial institutions operating in Hong Kong......

📋 Key Facts at a Glance Capital Gains Tax: Hong Kong does NOT tax genuine......

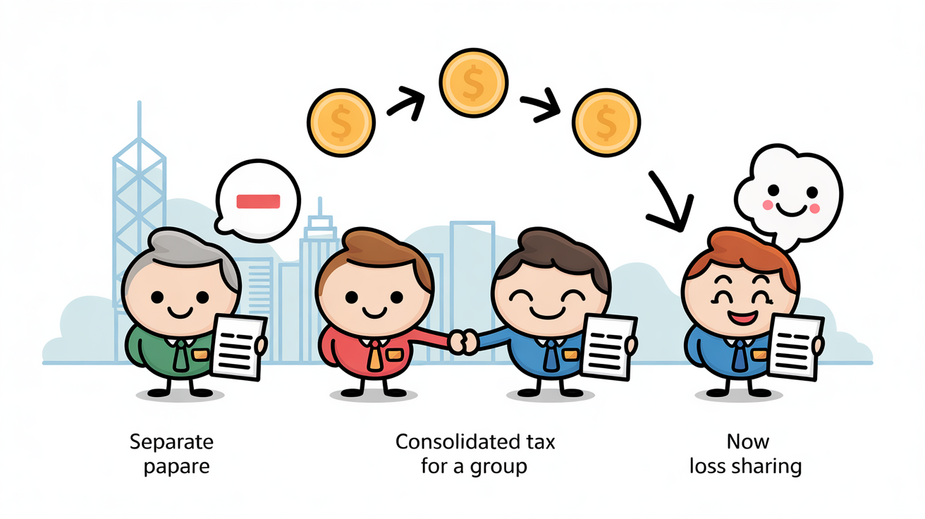

Hong Kong’s Corporate Tax Framework: Separate Entity Principle vs. Consolidated Options Hong Kong operates under......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308