Understanding Hong Kong Property Tax Fundamentals Navigating property ownership in Hong Kong necessitates a clear......

Hong Kong’s Unique Tax Landscape for Wealth Transfer Hong Kong presents a distinctive environment for......

Understanding Hong Kong's Territorial Basis of Taxation Hong Kong operates under a territorial principle of......

Global Tax Policy Shifts Reshaping Hong Kong The international tax landscape is currently undergoing a......

Hong Kong's Approach to Taxing Capital Gains Hong Kong operates under a territorial basis of......

Hong Kong's Ascendance as a Family Office Hub Hong Kong is rapidly consolidating its position......

Case Study Breakdown: $2.3M Compliance Failure Real-world examples provide invaluable insights into navigating complex regulatory......

Understanding the Dynasty Trust Structure A dynasty trust represents a sophisticated evolution in wealth planning,......

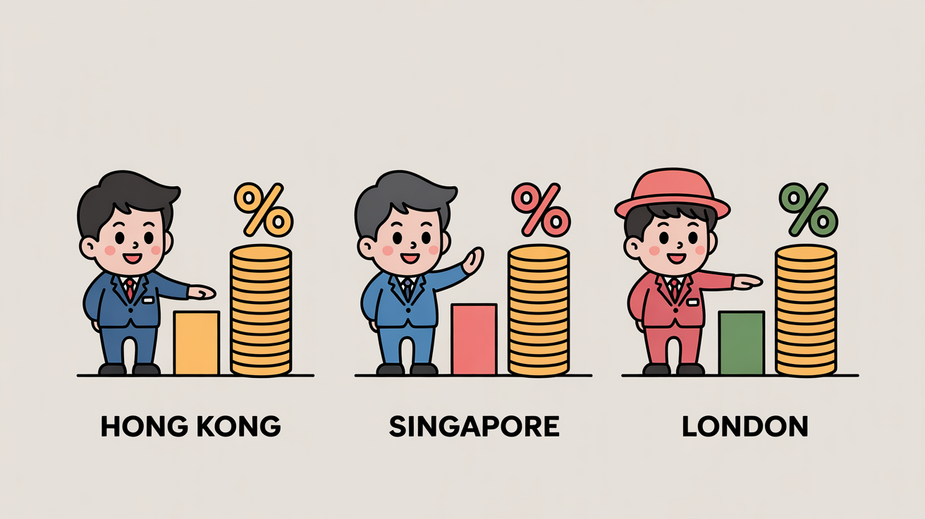

Understanding Stamp Duty Fundamentals in Key Financial Hubs Stamp duty is a fundamental fiscal instrument......

Current Trends Driving Hong Kong Tax Reforms Hong Kong's long-standing profits tax system, valued for......

Hong Kong's Evolving Tax Landscape: Navigating Global Shifts Hong Kong's standing as a premier international......

Maximizing Tax Benefits: A Guide to Hong Kong's Deduction Framework Navigating Hong Kong's tax landscape......

TAX.HK

Copyright © TAX.HK all right reserved. Gary Hui +(852)68388308