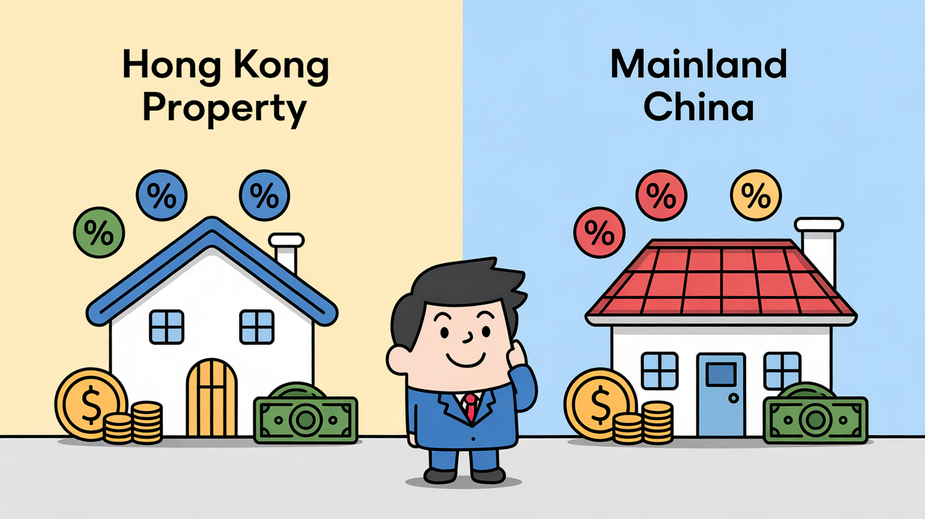

Hong Kong vs. Mainland China Property Tax: Key Differences for Cross-Border Investors

📋 Key Facts at a Glance

- Hong Kong Property Tax: 15% on net assessable value (rental income – rates – 20% statutory allowance)

- Stamp Duty Update: All special property duties (BSD, SSD, NRSD) abolished on February 28, 2024

- Capital Gains: Hong Kong has no capital gains tax; Mainland China imposes Land Appreciation Tax (30-60%)

- Estate Duty: Hong Kong abolished estate duty in 2006; Mainland China has no nationwide inheritance tax

- Double Taxation: Hong Kong-Mainland DTA prevents double taxation on cross-border property income

Are you considering building a property portfolio that spans both Hong Kong and Mainland China? With increasing economic integration and distinct market opportunities, cross-border property investment has become an attractive strategy for savvy investors. However, navigating the dramatically different tax landscapes of these two jurisdictions can make or break your investment returns. From acquisition costs to rental income taxation and eventual property disposal, understanding these differences is crucial for making informed decisions and avoiding costly surprises.

Property Acquisition: Upfront Costs Compared

The initial tax burden when purchasing property varies significantly between Hong Kong and Mainland China. Hong Kong’s system is relatively straightforward, while Mainland China’s involves multiple layers of taxes that can vary by region and property type.

Hong Kong Stamp Duty Structure (2024-2025)

Hong Kong uses a progressive ad valorem stamp duty system based on property value. The rates apply equally to all buyers regardless of residency status since the abolition of special duties.

| Property Value | Stamp Duty Rate |

|---|---|

| Up to HK$3,000,000 | HK$100 |

| HK$3,000,001 – 3,528,240 | HK$100 + 10% of excess |

| HK$3,528,241 – 4,500,000 | 1.5% |

| HK$4,500,001 – 4,935,480 | 1.5% to 2.25% |

| HK$4,935,481 – 6,000,000 | 2.25% |

| Above HK$21,739,120 | 4.25% |

Mainland China Acquisition Taxes

Mainland China’s property acquisition involves several taxes, with Deed Tax being the primary one. Rates vary by location, property type, and whether it’s your first home:

- Deed Tax: Typically 1-3% of transaction value, with lower rates for first homes

- Value Added Tax (VAT): 5% for commercial properties or residential sold within 2 years

- Registration Fees: Vary by city and property type

- Local Restrictions: Some cities have purchase restrictions for non-residents

Annual Holding Costs: Property Tax vs Rates

Once you own property, ongoing annual costs differ dramatically between the two jurisdictions. Hong Kong has a predictable system, while Mainland China’s approach varies by city and is still evolving.

Hong Kong Property Tax on Rental Income

Hong Kong imposes a 15% property tax on net assessable value of rental income. The calculation is straightforward:

For example, if you receive HK$300,000 annual rent and pay HK$15,000 in rates:

- Step 1: Gross rent: HK$300,000

- Step 2: Less rates paid: HK$300,000 – HK$15,000 = HK$285,000

- Step 3: Apply 20% statutory allowance: HK$285,000 × 80% = HK$228,000 (net assessable value)

- Step 4: Apply 15% tax rate: HK$228,000 × 15% = HK$34,200 annual property tax

Mainland China Rental Income Taxation

Mainland China treats rental income as part of your overall individual income, subject to Individual Income Tax (IIT) at progressive rates from 3% to 45%. This means your rental income tax depends on your total annual income from all sources.

| Aspect | Hong Kong | Mainland China |

|---|---|---|

| Tax System | Property Tax (separate tax) | Individual Income Tax (IIT) |

| Tax Rate | 15% flat rate on net assessable value | Progressive rates (3%-45%) based on total income |

| Deductions | 20% statutory allowance + actual rates paid | Actual expenses (repairs, management fees, taxes) |

| Annual Rates | Based on rateable value (typically 5%) | Pilot programs vary by city (Shanghai, Chongqing) |

Capital Gains: The Biggest Difference

This is where the tax treatment diverges most dramatically. Hong Kong’s approach is investor-friendly, while Mainland China’s system can significantly impact your returns.

Hong Kong: No Capital Gains Tax

Hong Kong does not impose a capital gains tax on property sales. However, there’s an important caveat: if the Inland Revenue Department determines you’re engaged in property trading as a business, profits could be subject to Profits Tax at 8.25% (first HK$2 million) or 16.5% (remainder).

Factors that might trigger Profits Tax treatment include:

- Frequent property transactions (buying and selling quickly)

- Short holding periods (typically less than 2 years)

- Financing arrangements suggesting trading intent

- Marketing properties as investments for resale

Mainland China: Land Appreciation Tax (LAT)

Mainland China imposes Land Appreciation Tax on property sales, with progressive rates from 30% to 60% based on the appreciation amount. The calculation is complex:

| Appreciation Ratio | LAT Rate | Quick Deduction |

|---|---|---|

| ≤ 50% | 30% | 0% |

| 50-100% | 40% | 5% |

| 100-200% | 50% | 15% |

| > 200% | 60% | 35% |

Wealth Transfer and Inheritance

Planning for the future transfer of property assets requires understanding very different approaches to inheritance taxation.

Hong Kong: No Estate Duty Since 2006

Hong Kong abolished estate duty on February 11, 2006. This means property and other assets located in Hong Kong can be transferred to beneficiaries without inheritance tax, regardless of the owner’s residency status. This makes Hong Kong particularly attractive for long-term wealth preservation and transfer.

Mainland China: No Nationwide Inheritance Tax

Mainland China does not currently have a nationwide inheritance tax system. However, there have been periodic discussions about implementing one, and some pilot programs have been considered. The inheritance process is governed by civil law, and while there’s no direct inheritance tax, there may be administrative fees and other costs associated with property transfer upon death.

Avoiding Double Taxation: The DTA Solution

One of the biggest concerns for cross-border investors is being taxed twice on the same income. Fortunately, Hong Kong and Mainland China have a comprehensive Double Taxation Arrangement (DTA) that addresses this issue.

Key provisions of the Hong Kong-Mainland China DTA for property investors:

- Rental Income: Generally taxed in the country where the property is located

- Capital Gains: Taxed in the country where the property is situated

- Tax Credits: Taxes paid in one jurisdiction can be credited against tax liability in the other

- Permanent Establishment: Rules prevent artificial shifting of profits

To claim DTA benefits, you’ll need to:

- Step 1: Determine your tax residency status in both jurisdictions

- Step 2: Document all income and taxes paid in each country

- Step 3: Apply for tax residency certificates if required

- Step 4: File tax returns in both jurisdictions with proper DTA claims

Compliance and Strategic Planning

Managing cross-border property investments requires careful attention to compliance requirements in both jurisdictions. Here are the key considerations:

Hong Kong Compliance Requirements

- Annual Tax Returns: Filed for the tax year ending March 31

- Record Keeping: Maintain records for 7 years

- Property Tax Returns: Due within 1 month of issuance (typically April-May)

- Stamp Duty Payment: Must be paid within 30 days of property purchase

Mainland China Compliance Considerations

- Monthly/Quarterly Reporting: Some taxes require more frequent filing

- Local Variations: Compliance requirements can vary by city

- Foreign Ownership Restrictions: Some cities limit property ownership by non-residents

- Currency Controls: Consider RMB conversion and repatriation rules

✅ Key Takeaways

- Hong Kong offers simpler, more predictable property taxation with no capital gains tax and no estate duty

- Mainland China has more complex, variable taxation with significant holding period considerations

- The Hong Kong-Mainland DTA prevents double taxation but requires proper documentation and claims

- Recent Hong Kong stamp duty reforms (abolition of BSD/SSD/NRSD) make property acquisition more accessible

- Cross-border compliance requires attention to both jurisdictions’ reporting requirements and deadlines

- Strategic holding structures and timing can optimize tax outcomes in both markets

Building a successful cross-border property portfolio between Hong Kong and Mainland China requires more than just market analysis—it demands a thorough understanding of two distinct tax systems. While Hong Kong offers simplicity and favorable treatment for long-term investors, Mainland China presents opportunities with different risk-reward dynamics. The key to success lies in proactive tax planning, proper compliance, and leveraging the Double Taxation Arrangement to avoid double taxation. Whether you’re a first-time cross-border investor or expanding an existing portfolio, consulting with tax professionals experienced in both jurisdictions is essential for optimizing your investment strategy and protecting your returns.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Property Tax Guide – Official property tax calculation and rates

- IRD Stamp Duty Guide – Current stamp duty rates and regulations

- State Taxation Administration (China) – Mainland China tax regulations

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.