Hong Kong’s Beneficiary Deed Strategy: Flexible Inheritance for Modern Families

📋 Key Facts at a Glance

- Hong Kong Estate Duty: Abolished since February 11, 2006 – no inheritance tax on Hong Kong assets

- Probate Bypass: Beneficiary deeds allow direct asset transfer, avoiding 6-12 month probate delays

- Stamp Duty Impact: Property transfers via beneficiary deeds still subject to current stamp duty rates (up to 4.25%)

- Flexibility: Revocable structure allows updates for life changes without complex legal procedures

- Privacy Protection: Transfers occur outside public probate records, maintaining family confidentiality

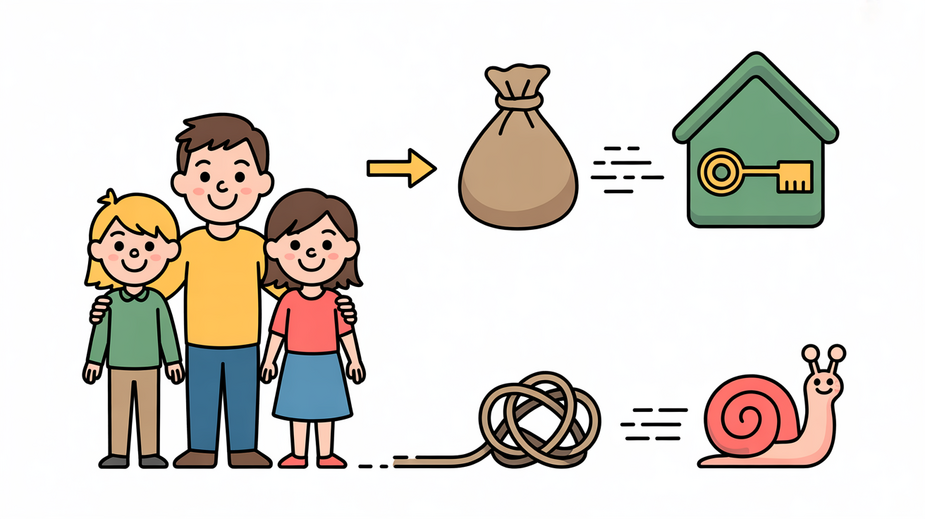

In today’s rapidly evolving financial landscape, how do you ensure your legacy reaches the right people at the right time? With Hong Kong families becoming increasingly blended, international, and complex, traditional estate planning methods often fall short. The beneficiary deed strategy offers a modern solution that combines flexibility, efficiency, and control—perfect for navigating the unique challenges of wealth transfer in our dynamic city.

Why Traditional Wills Struggle with Modern Family Dynamics

Traditional wills, while foundational to estate planning, face significant challenges in today’s complex environment. The probate process in Hong Kong can take 6-12 months or longer, during which assets remain frozen and inaccessible to beneficiaries. This delay can create financial hardship for heirs who may need immediate access to funds for living expenses, education, or business needs.

The Blended Family Challenge

Modern families often include children from previous marriages, stepchildren, and complex kinship networks that don’t fit traditional inheritance models. A conventional will may struggle to address these intricate relationships clearly, potentially leading to disputes, ambiguity, or unintended distribution outcomes.

| Traditional Will Limitations | Impact on Modern Families |

|---|---|

| Lengthy probate process (6-12+ months) | Assets frozen, beneficiaries face financial strain during waiting period |

| Static document structure | Rapidly outdated by life changes (marriages, births, divorces) |

| Public court proceedings | Lack of privacy, family financial matters become public record |

| Complex international coordination | Difficult to manage cross-border assets and beneficiaries |

How Beneficiary Deeds Work: The Modern Alternative

A beneficiary deed represents a significant evolution in asset transfer strategy. Unlike traditional wills that must go through probate, beneficiary deeds facilitate direct transfer of specified assets to designated beneficiaries immediately upon the owner’s passing. This bypass of the probate system offers several key advantages for Hong Kong families.

Core Mechanics and Benefits

- Direct Transfer: Assets pass directly to beneficiaries without court intervention

- Revocable Structure: Complete control retained during lifetime with easy amendments

- Multi-Tier Designations: Primary and contingent beneficiaries can be specified

- Asset Consolidation: Multiple property types can be managed under single instrument

- Seamless Integration: Works alongside existing wills, trusts, and insurance policies

Strategic Advantages for Hong Kong Families

The beneficiary deed strategy offers distinct advantages that align perfectly with Hong Kong’s unique financial environment and family structures. Here’s how it compares to conventional approaches:

| Key Advantage | Beneficiary Deed | Traditional Will |

|---|---|---|

| Asset Access Speed | Immediate transfer upon death verification | 6-12+ months through probate |

| Privacy Protection | Private transfer outside court records | Public probate proceedings |

| Flexibility for Changes | Easy amendments without rewriting entire document | Requires formal codicils or new will |

| Cost Efficiency | Lower administrative costs post-death | Higher probate and legal fees |

| International Coordination | Simplifies cross-border transfers | Complex multi-jurisdiction probate |

Tax Efficiency in Hong Kong’s Unique Environment

Hong Kong’s tax landscape offers significant advantages for inheritance planning, but strategic asset allocation remains crucial for maximizing efficiency. Understanding how beneficiary deeds interact with current tax regulations is essential for preserving wealth for future generations.

Hong Kong’s Favorable Tax Environment

Hong Kong abolished estate duty effective February 11, 2006, meaning there is generally no inheritance tax on assets situated within Hong Kong. This simplifies planning considerably compared to jurisdictions with significant death taxes. However, other tax considerations remain important:

- Stamp Duty: Property transfers via beneficiary deeds are subject to current stamp duty rates (up to 4.25% depending on property value)

- No Capital Gains Tax: Hong Kong does not tax capital gains, benefiting property appreciation

- No Dividend Withholding: Investment income passes tax-efficiently to beneficiaries

- Cross-Border Considerations: Foreign assets or non-resident beneficiaries may face overseas tax liabilities

Tailoring Solutions for Blended and International Families

Hong Kong’s position as an international hub means many families have cross-border elements. Beneficiary deeds offer particular advantages for these complex situations:

Protecting Children from Previous Marriages

A well-structured beneficiary deed can directly designate specific assets to children from previous marriages, ensuring their inheritance is protected and not subject to potential claims or dilution through subsequent distributions. This direct approach provides clarity and prevents assets intended for specific heirs from being inadvertently diverted.

Balancing Spousal and Children’s Rights

The revocable nature of beneficiary deeds allows for careful balancing between providing for a surviving spouse and securing inheritance for children from all relationships. Assets can be allocated to ensure the spouse is adequately provided for during their lifetime while simultaneously protecting children’s future inheritance.

Managing International Complexity

For families with beneficiaries in different jurisdictions, beneficiary deeds simplify the transfer process compared to navigating complex international probate procedures. While foreign laws still apply at the receiving end, the direct transfer mechanism streamlines the Hong Kong side of the process.

Implementing a Future-Proof Inheritance Strategy

Creating a robust inheritance strategy requires ongoing attention and adaptation. Here’s how to implement a beneficiary deed strategy that stands the test of time:

- Conduct a Comprehensive Asset Review: Identify which assets are suitable for direct transfer via beneficiary deed versus those better handled through traditional wills or trusts

- Coordinate with Existing Plans: Ensure beneficiary deeds work harmoniously with existing life insurance, retirement accounts, and trust structures

- Address Digital Assets: Include digital accounts, cryptocurrencies, and online assets in your comprehensive plan

- Establish Review Triggers: Set reminders to review and update your strategy after major life events (marriages, births, deaths, significant financial changes)

- Professional Consultation: Work with qualified legal and tax professionals familiar with Hong Kong’s specific regulations and cross-border implications

✅ Key Takeaways

- Beneficiary deeds bypass Hong Kong’s lengthy probate process (6-12+ months), providing immediate asset access to beneficiaries

- Hong Kong’s abolition of estate duty since 2006 creates a favorable environment for tax-efficient wealth transfer

- The revocable structure allows easy updates for life changes without complex legal procedures

- Particularly effective for blended families, protecting children from previous marriages while balancing spousal rights

- Streamlines international inheritance by simplifying cross-border asset transfers from Hong Kong

- Works best as part of a comprehensive strategy alongside traditional wills, trusts, and insurance policies

In Hong Kong’s dynamic financial landscape, where families are increasingly blended and international, the beneficiary deed strategy offers a powerful tool for modern inheritance planning. By combining the efficiency of direct asset transfer with Hong Kong’s favorable tax environment, this approach provides the flexibility and control needed to navigate complex family structures and ensure your legacy reaches the right people at the right time. Remember that while beneficiary deeds offer significant advantages, they work best as part of a comprehensive estate plan developed with professional guidance tailored to your specific circumstances.

📚 Sources & References

This article has been fact-checked against official Hong Kong government sources and authoritative references:

- Inland Revenue Department (IRD) – Official tax rates, allowances, and regulations

- Rating and Valuation Department (RVD) – Property rates and valuations

- GovHK – Official Hong Kong Government portal

- Legislative Council – Tax legislation and amendments

- IRD Estate Duty Information – Official confirmation of estate duty abolition

- GovHK Stamp Duty Rates – Current property transfer duty rates

- Hong Kong Judiciary – Probate Registry – Official probate process information

Last verified: December 2024 | Information is for general guidance only. Consult a qualified tax professional for specific advice.