Understanding Hong Kong’s Progressive Two-Tier Profits Tax

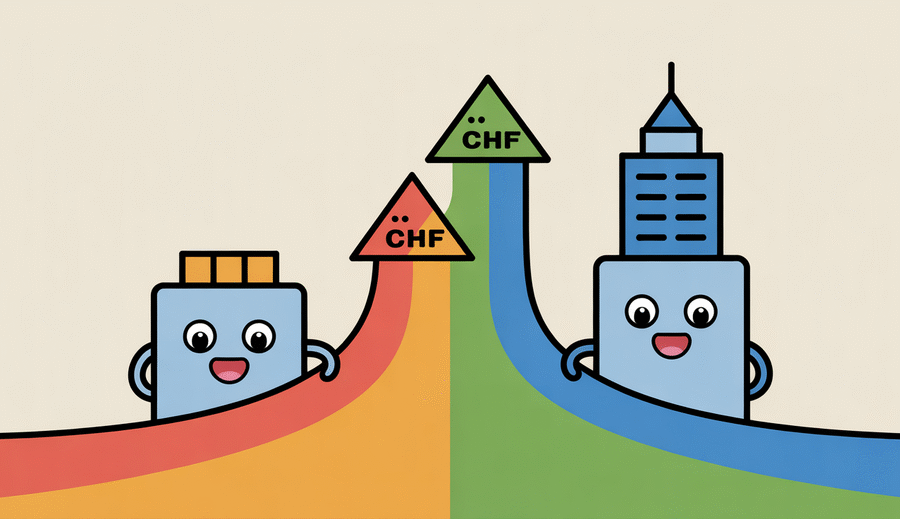

Hong Kong distinguishes itself with a progressive two-tiered profits tax structure, a design aimed at fostering a more equitable and growth-friendly environment for businesses operating within the territory. Unlike a flat tax system that applies a single rate to all taxable profits, this regime utilizes different rates for distinct bands of a company’s profit. This approach directly benefits smaller operations and startups while maintaining a competitive rate for larger enterprises, positioning it as a core element of Hong Kong’s appeal as a global business hub.

The fundamental mechanism involves applying two distinct tax rates based on a company’s assessable profits. A significantly reduced tax rate is applied to the initial segment of assessable profits up to a specified threshold. Profits exceeding this threshold are then subject to the standard profits tax rate. This system taxes the *profit* itself in brackets, rather than classifying companies by size and applying a single rate to their entire income, effectively creating two tax tiers applicable to every eligible company.

The critical differentiator between these two tiers is the profit threshold set by the Hong Kong government. Under the current structure, the first HK$2 million of assessable profits earned by a qualifying corporation is taxed at a preferential rate of 8.25%. Any assessable profits exceeding this HK$2 million mark in the same assessment year are then subject to the standard profits tax rate of 16.5%. This clear threshold provides a concrete benchmark for businesses to understand their potential tax liabilities and manage cash flow more effectively, particularly in their early growth stages.

This progressive regime is firmly anchored in Hong Kong’s legislative landscape, primarily governed by the Inland Revenue Ordinance (IRO). The IRO provides the detailed framework, eligibility criteria, and rules for calculating assessable profits and applying the two-tiered rates. It includes specific provisions, such as rules preventing related entities from artificially multiplying their access to the lower tax band. This robust legislative backing ensures the system’s transparency, fairness, and stability, providing businesses with confidence and predictability in their tax planning within the territory.

The structure can be summarized as follows:

| Assessable Profits Band | Applicable Profits Tax Rate |

|---|---|

| First HK$2,000,000 | 8.25% |

| Profits exceeding HK$2,000,000 | 16.5% |

Understanding these mechanics is crucial for any business operating or considering establishing a presence in Hong Kong, as the two-tier system significantly impacts tax obligations and financial strategy compared to traditional flat tax models.

Addressing the Limitations of Traditional Flat Tax Models

Traditional flat tax models for corporate profits, while often perceived as simple, frequently present significant challenges in a diverse economic landscape. Their fundamental issue lies in the inherent “one-size-fits-all” application of a single tax rate regardless of a company’s size, profitability, or stage of development. This uniform treatment fails to acknowledge the vastly different financial capacities and growth requirements of small startups compared to large, established enterprises. A rate that might be manageable or even attractive for a multinational corporation can impose a substantial burden on a fledgling business or a rapidly scaling SME.

One critical drawback of a rigid flat tax system is the potential for creating growth disincentives, particularly for Small and Medium-sized Enterprises. As an SME increases its profitability, every additional dollar of profit is taxed at the same rate as a large corporation’s earnings. This can reduce the amount of capital available for vital reinvestment in expansion, hiring, research, or development. Without a lower tax rate on initial profits, scaling businesses may find the effective tax burden disproportionately high, potentially hindering their ability to compete, innovate, and create jobs compared to environments with more graduated tax systems designed to support growth in early stages.

Furthermore, a flat tax can create competitive disadvantages within the global corporate tax landscape. In an increasingly interconnected world, jurisdictions compete fiercely to attract and retain businesses. Countries or regions offering more tailored tax structures that provide relief or incentives based on size, profitability, or investment may become more attractive destinations for businesses at various life stages. A flat tax, especially if set at a rate necessary to secure sufficient government revenue from larger entities, might render a location less competitive for the very businesses needed for dynamic economic growth – particularly innovative startups and ambitious SMEs looking to scale. Hong Kong’s two-tiered system is designed to mitigate these very issues, providing targeted support where traditional flat taxes fall short.

Tailored Advantages for SMEs and Startups

Hong Kong’s two-tiered profits tax regime offers significant, deliberate advantages specifically designed to foster the growth and sustainability of Small and Medium-sized Enterprises (SMEs) and emerging startups. Understanding these tailored benefits is crucial for new businesses looking to establish a presence and existing SMEs aiming for expansion in the city. The primary and most impactful benefit is the substantially reduced tax rate applied to their initial profits, providing a crucial financial boost during critical growth phases.

Under this progressive structure, qualifying businesses benefit from a preferential tax rate of just 8.25% on their first HK$2 million of assessable profits. This rate is half of the standard profits tax rate, representing a significant portion of a company’s early earnings that remains available for internal use rather than being paid out as tax. For businesses navigating early-stage challenges, scaling operations, or facing tight budgets, this preservation of capital is invaluable, providing essential resources needed for development and stability.

The ability to retain a larger percentage of early profits directly translates into enhanced cash flow and increased capital availability. This improved liquidity empowers SMEs and startups to reinvest funds back into their operations. Whether it involves hiring talent, developing innovative products or services, expanding market reach, upgrading technology, or building necessary infrastructure, the retained cash provides the essential fuel for growth and competitiveness in a dynamic market. It allows these businesses to be more agile and responsive to opportunities and challenges without facing immediate, high tax burdens on their foundational profits.

Beyond the financial benefits, the clarity and simplicity of the lower tax tier contribute to a reduced perceived compliance burden for emerging businesses. While all companies must adhere to filing requirements, knowing that the tax calculation for their core profit bracket is straightforward and at a significantly lower rate simplifies financial planning and tax provisioning. This clear structure helps smaller businesses with potentially fewer dedicated accounting resources to navigate their tax obligations with greater confidence, allowing them to focus more on their core business activities rather than complex tax computations. The structure is fundamentally designed to encourage entrepreneurship and support the foundational years of new ventures in the Hong Kong economy.

Strategic Benefits for Established Enterprises

While the lower tier of Hong Kong’s profits tax regime provides clear advantages for small and medium-sized enterprises, the structure is equally beneficial strategically for established, larger businesses. These companies, primarily subject to the standard rate on the majority of their profits, still find the two-tiered system and the broader tax framework highly favourable for their operations and expansion strategies due to a competitive rate and fundamental tax principles.

For established businesses with assessable profits exceeding the HK$2 million threshold, the rate applied to the portion of profits above this amount is the standard profits tax rate of 16.5%. This rate remains highly competitive when compared to corporate tax rates in many other jurisdictions globally, providing a predictable and relatively low tax burden on substantial earnings. Crucially, even larger companies benefit from the lower 8.25% rate on their *first* HK$2 million of assessable profits. While this portion represents a smaller percentage of their total income compared to an SME, it effectively lowers their overall effective tax rate compared to a flat 16.5% rate applied from the first dollar, contributing to overall tax efficiency.

A key advantage for established enterprises, particularly those with international operations, is the seamless integration of the 16.5% standard rate with Hong Kong’s territorial principle of taxation. This principle dictates that only profits sourced within Hong Kong are subject to profits tax. Profits derived from activities or sources outside Hong Kong are generally not taxable, regardless of whether the company is registered or managed in Hong Kong. This powerful combination of a competitive rate on Hong Kong-sourced income and the exemption of foreign-sourced income creates an exceptionally attractive environment for multinational corporations seeking a regional base.

This favourable fiscal environment provides a significant competitive edge in cross-border expansion and international operations. Established enterprises can leverage Hong Kong as a base for regional headquarters or international operations without incurring Hong Kong profits tax on income generated from their overseas activities, provided that income is indeed sourced outside Hong Kong. This allows businesses to structure their global operations efficiently, manage diverse income streams effectively, and remain highly competitive in the international market. The clarity and stability of the 16.5% rate on local profits, coupled with the robust territorial system, support long-term strategic planning and investment decisions for established companies operating on a larger, often global, scale.

Streamlined Compliance and Administration

A significant strength of Hong Kong’s two-tiered profits tax regime lies in its commitment to simplifying the compliance process, benefiting businesses regardless of their size or applicable tax rate. Rather than creating complex parallel systems or requiring vastly different procedures, the framework ensures a streamlined administrative experience for all taxpayers. This focus on ease of compliance is a key factor in Hong Kong’s appeal as a business hub, minimizing administrative burden that can often disproportionately affect smaller enterprises while also providing clarity and efficiency for larger corporations.

A fundamental aspect of this simplification is the unified filing process. All companies operating in Hong Kong submit the same type of Profits Tax Return, irrespective of whether they anticipate their profits primarily falling into the lower 8.25% tier or the standard 16.5% tier. This means businesses do not need to navigate different forms, complex schedules, or disparate procedures based solely on their profit levels. This standardization creates a predictable and efficient annual tax reporting routine that is accessible and manageable for both new market entrants and long-established entities.

Furthermore, the eligibility criteria for applying each tax bracket are exceptionally clear and easy to determine. The primary differentiator is a single, clearly defined profit threshold – currently set at HK$2 million. Profits up to this specific amount are taxed at the lower rate, while profits exceeding it are taxed at the standard rate. This straightforward calculation allows businesses to easily ascertain their applicable rates based on their reported assessable profits, removing ambiguity and potential complexities often associated with multi-tiered or progressive tax systems that might involve numerous brackets, intricate phase-out rules, or complex calculations based on factors other than taxable profit.

To further assist businesses and enhance administrative ease, the Inland Revenue Department (IRD) provides various resources, including automated calculation tools and comprehensive guidance notes. These digital aids help companies accurately compute their tax liabilities based on reported profits and the applicable two-tier rates. Such tools are invaluable for reducing the risk of errors, speeding up the preparation of tax returns, and ensuring businesses can meet their obligations efficiently. The availability of clear guidance and supportive digital infrastructure from the tax authority reinforces the regime’s focus on administrative ease for all taxpayers operating within its framework, underpinning the broader objective of fostering a business-friendly environment.

Comparative Analysis with Regional Tax Systems

Understanding Hong Kong’s two-tiered profits tax regime is significantly enhanced by comparing its features with the tax structures of key regional competitors. This comparative analysis highlights the unique benefits and competitive advantages Hong Kong offers to businesses operating in Asia. While many jurisdictions in the region seek to attract investment through tax policies, Hong Kong’s approach effectively balances simplicity with targeted rate reduction for smaller profit earners, positioning it distinctly in the global landscape and reinforcing its attractiveness as a base for regional operations.

Comparing Hong Kong to Singapore, a prominent regional financial hub, reveals differing strategies. Singapore employs a headline corporate tax rate of 17% but provides significant partial exemptions on the first amount of chargeable income and often a rebate, effectively lowering the tax burden for small and medium-sized businesses on their initial profits. Hong Kong’s system, however, features a clear, explicitly lower rate of 8.25% applied directly to the first HK$2 million of assessable profits, providing a substantial and easily calculable reduction on a significant initial profit block before the standard 16.5% rate applies to the remainder. This distinct, tiered structure offers a transparent and easily understood benefit for businesses reaching into the lower-to-mid profit range.

Contrasting with mainland China further illustrates Hong Kong’s competitive edge. Mainland China generally imposes a corporate income tax rate of 25%, with preferential rates (like 20% or 15%) available based on size, industry, or location, often creating a more complex structure and potentially higher overall tax burden, especially for larger enterprises. Furthermore, mainland China operates primarily on a worldwide tax basis for resident enterprises, taxing income regardless of where it is earned. Conversely, Hong Kong adheres strictly to a territorial principle, taxing only profits sourced within Hong Kong. This territoriality principle, combined with the transparent two-tiered rate structure, provides significant advantages for international businesses using Hong Kong as a base for regional or global operations, as foreign-sourced income is generally tax-exempt.

Hong Kong’s system also positions itself clearly in the context of evolving global tax initiatives, such as those from the OECD aimed at preventing base erosion and profit shifting (BEPS). Its territorial principle and relatively low, straightforward rates align with the need for transparent and competitive tax environments. While global discussions around minimum taxes and profit allocation continue, Hong Kong’s clear, simple structure helps businesses understand their liabilities readily, contributing to tax certainty and compliance ease compared to more convoluted or higher-rate systems found elsewhere in the region. This comparative simplicity, coupled with the tangible financial benefits of the two tiers and territoriality, is a key factor in its enduring attractiveness as a place to do business.

| Feature | Hong Kong | Singapore | Mainland China |

|---|---|---|---|

| System Type | Two-Tier Profits Tax | Corporate Tax (Partial Exemption Scheme) | Progressive Corporate Income Tax |

| Lowest Statutory / Effective Rate (Approximate) | 8.25% (first HK$2M) | Lower effective rates on initial income due to exemptions/rebates | 15% / 20% (preferential rates for specific entities/industries) |

| Highest Standard Rate | 16.5% (profits over HK$2M) | 17% (standard corporate tax rate) | 25% (standard corporate income tax rate) |

| Tax Basis | Territorial Source Principle | Territorial Source Principle (with exceptions) / Worldwide (for resident companies depending on income type) | Worldwide (for resident enterprises); Territorial (for non-resident enterprises with PEs) |

Future-Proofing Through Adaptive Tax Policies

Hong Kong’s two-tiered profits tax system is strategically designed not to be static; a crucial element of its long-term success lies in its inherent adaptability to changing economic conditions and the evolving global tax landscape. The government employs several mechanisms to ensure the regime remains relevant and effective in a constantly evolving environment, demonstrating a proactive approach to fiscal management that looks beyond immediate needs.

One key aspect of this forward-thinking design involves the potential for adjustments to tax brackets and rates. While not strictly automatic to counter inflation, the framework allows for periodic review and potential recalibration of the thresholds and rates based on economic performance, government revenue needs, and the objective of maintaining competitiveness. This allows policymakers to ensure the thresholds differentiating the lower 8.25% rate and the standard 16.5% rate remain appropriate and that the rates continue to support business growth and attract investment without being eroded by economic shifts over time.

Furthermore, the commitment to adaptive policy is clearly evident in the ongoing process of government consultations and industry engagement. These dialogues involve soliciting feedback from businesses, tax professionals, and other stakeholders to evaluate the regime’s performance, identify practical challenges, and explore potential areas for optimization. This consultative approach allows policymakers to stay attuned to the real-world impacts of the tax rules and make informed decisions about potential rate adjustments, threshold modifications, or other refinements necessary to enhance fairness, competitiveness, and administrative efficiency in response to genuine economic or business needs.

Navigating the complexities of international tax reform is another critical component of future-proofing. Hong Kong must balance its objective of maintaining a highly competitive tax environment with the need to align with global initiatives aimed at preventing base erosion and profit shifting (BEPS), including proposals like the OECD’s Pillar Two (Global Minimum Tax). This involves carefully considering how local policies interact with evolving international standards, ensuring compliance where necessary while safeguarding the territory’s fundamental attractiveness as a business hub. By actively engaging with these global changes and adapting its framework thoughtfully, Hong Kong positions its two-tiered tax regime to remain sustainable, competitive, and recognized within the broader international tax framework for years to come.